Applying Guide

On this page, you can find application instructions when you are applying for earnings-related daily allowance, mobility allowance, or restructuring protection allowance.

Applying

On this page, you will find

These instructions apply to you if you are an A-kassa member and you

- are unemployed

- are laid off

- have finished studying and are not in a full-time employment relationship

- have received sickness allowance for the maximum period (approx. 300 days)

Check the general conditions for the earnings-related daily allowance on the earnings-related allowance page.

1. Register as a jobseeker

Register as a jobseeker at Job Market Finland’s E-services.

To receive daily allowance, you must be registered as an applicant for full-time employment. Start your job search immediately on your first day of unemployment or lay-off, or even beforehand. Jobseeker status cannot be granted retroactively for past dates, so remember to register on time.

Keep your jobseeker status in effect in accordance with instructions provided by the employment authority. You will lose your eligibility for earnings-related allowance entirely if you are absent from the job market for more than 6 months without an acceptable reason.

Read more about the prerequisites for earnings-related allowance.

2. Compile your appendices

Before you send your first application, you should make good use of the time you have available and compile all required appendices.

When you send your application together with all the appendices, you receive your daily allowance decision quicker.

If your permanent employment has ended:

- due to dismissal or if you resigned yourself, submit the notice of termination.

- by mutual agreement, submit the agreement on the termination of the employment.

- due to bankruptcy, submit the notice of termination and payslips showing any holiday compensation or holiday bonus paid at the end of the employment.

If your employment has ended due to a fixed-term contract expiring, submit, for example, the employment contract or a certificate of employment that shows the fixed-term nature of the job.

Check this list of appendices for the appendices you should look up and prepare beforehand.

3. Request a revised tax card where necessary

We receive your salary tax card information automatically from the Tax Administration. However, we always withhold a tax of at least 25% from your earnings-related allowance, even if the rate entered in your tax card is lower.

If you wish to change the tax rate withheld from your earnings-related allowance, please request a revised tax card for benefits via MyTax. Enter the Open Unemployment Fund as the payer of the benefit. The Tax Administration then sends your electronic tax card automatically to us.

You will need an estimate of your earnings-related allowance for the revised tax card. The estimate can be calculated with the daily allowance calculator.

4. Apply for earnings-related allowance in eService

Daily allowance applications are always submitted retroactively. Fill out the applications and add any appendices electronically in eService. eService provides guidance for filling out the application.

If you cannot use the eService, you can fill out and submit a printed application.

First-time applicants:

Submit your first application no earlier two full calendar weeks (Mon–Sun) after your employment relationship has ended or your lay-off has started.

If your unemployment or lay-off

- starts on a Monday, fill out your first application for the two full calendar weeks from Monday to Sunday.

- starts midweek, fill out your application until the end of that week and for two full calendar weeks from Monday to Sunday.

Note! Even if your lay-off lasts only one day, you should always fill out your application for at least one full calendar week from Monday to Sunday.

Follow-up applications:

Fill out follow-up applications for a period of four calendar weeks (Mon–Sun) or a calendar month.

Application period:

You can submit your application no earlier than on the last day of your application period.

Example: If your application period is a calendar month, you can submit your January application for the period of Jan 1–Jan 31 no earlier than on the last day of January (the 31st).

Your daily allowance application must be submitted no later than three months from the first day of the application period.

Example: You become unemployed on January 1 and want to apply for earnings-related allowance for January. In this case, the application must reach the fund by April 1st.

Appendices:

Include appendices in your application. You can submit your application even if you do not have all the appendices available. If you plan on submitting the appendices later, you can explain this in the additional information section of the application. We will process the application as soon as we have all the necessary information.

We will contact you if we need more information to process your application.

5. Find employment with the help of A-kassa's job search support services

Make good use of the job search support services provided by A-kassa to its members. The services are included in the fund’s membership fee, and they are entirely optional. If you are a member of a trade union, you should also see if your union offers job search support services.

With the help of the EmploymentWizard, you can find suitable jobs and create professional-looking applications and CVs. It also provides career coaching and personalised service suggestions.

A collaborative effort with Barona, A-kassa’s Labour Exchange Service provides a dedicated job search channel. A single job application is all that is needed for you to be considered for vacancies across all fields and industries relevant to your interests. You may also be offered the opportunity to apply for apprenticeships and recruitment training programmes.

Our EmploymentWebinars provide up-to-date information for your job search, tips on assessing and identifying your competences and new perspectives on finding a job.

6. Track the processing of your application in the e Service.

The processing status of your application is displayed on the eService homepage and the Status Information tab. The different processing statuses are as follows:

- Received

- In process

- Pending further clarification

- Processed

When your application status is Received, it means that your application has been received and is waiting for processing.

When your application status is In process, it is already being processed by one of our processors.

If your application status is Pending further clarification, it means that we are waiting for you, the TE Office (a labour policy statement), your employer, the Incomes Register or Kela to provide us further information. The application may also have multiple additional reports pending at the same time.

When your application status is Processed, it is ready.

You will see the decision and the payment notification in eService the following weekday evening at the latest.

The explanations of the processing statuses are available via the info button in the eService Status Information tab.

The up-to-date processing status of your application is available here. We update the situation each working day.

Lay-offs come in different forms, which affect whether the earnings-related daily allowance is paid in full or adjusted according to earned income. This, in turn, affects the final amount of daily allowance paid to you.

A lay-off is considered full time when you are laid off from a full-time job for a minimum of one full calendar week from Monday to Sunday. If your full-time lay-off period does not include any days for which salary is paid, all lay-off days can be specified as unemployment days in your application. You should detail actual information for weekends as well instead of using the ‘weekend’ entry in the online application.

If you have other work or you engage in entrepreneurial activities, this must be specified in the application. If you are laid off full-time but you have a payday from another part-time or full-time job (lasting a maximum of two weeks) during the calendar month or four-week period, this income must be taken into account. In this case, your daily allowance will be adjusted, meaning that the adjustment for income from other work is payment-based, i.e. determined at the time of payment.

Midweek holidays must always be entered in the application as ‘other reason: midweek holiday,’ if you receive a separate midweek holiday compensation for them or if your salary is not subject to midweek holiday salary reduction during your lay-off week.

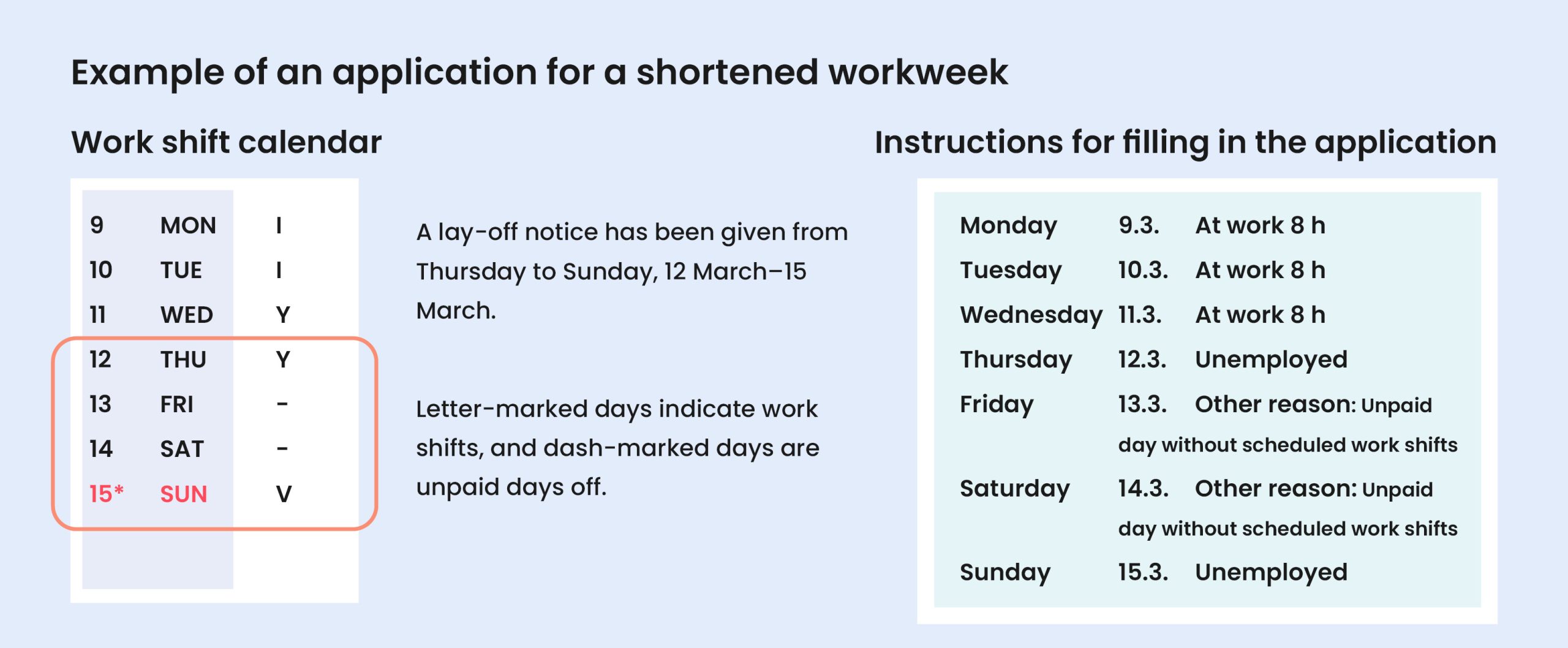

A lay-off that does not last a full calendar week from Monday to Sunday is considered a lay-off for a shortened workweek. For instance, a lay-off which lasts from Wednesday until Tuesday the following week constitutes a lay-off for a shortened workweek. When processing an application for a shortened workweek, the unemployment fund must review the actual loss of salary. This is because paying out an unemployment benefit requires that the employee receive reduced salary in accordance with their reduced working hours.

For a shortened workweek, you must always fill out an application covering a full calendar week (Monday to Sunday) because the unemployment fund has to ensure that your working hours for the lay-off week do not exceed 80% of your full-time working hours. You should also note that, as stated in the Unemployment Security Act, a calendar week may include a maximum of five working days, unemployment days or waiting period days. Those laid off from shift work may end up with a calendar week which includes a lay-off day and five working days. In such cases, the unemployment fund cannot pay daily allowance for the lay-off day because the calendar week in question already includes the maximum number of days subject to compensation, i.e. five working days.

In your application for a shortened workweek, only days with a reduced salary due to lay-off may be reported as unemployment days. You should detail actual information for weekends as well. If you have other work or you engage in entrepreneurial activities, this must be specified in the application. In case of a lay-off for a shortened workweek, you have to report the days you have actually worked in another job. This is because income earned on these working days is adjusted using the earnings-based model, i.e. for the time period the work took place.

If you have been laid off from shift work, such as work that observes the TAM37 working time system, potentially including work shifts for every day of the week, you should enter ‘unemployed’ in your application for the day you were scheduled to start the shift for which you have been laid off. For instance, if your lay-off starts on Monday with a night shift from 10 p.m. to 6 a.m., you should enter Monday as your unemployed day even though the lay-off hours extend to Tuesday.

If your lay-off notice was issued for a period shorter than a full calendar week for which both unpaid days without work shifts and paid working days were scheduled, only the days which had shorter working hours and for which no salary was paid due to the lay-off should be entered in the application as lay-off days. During a shortened workweek, it is not possible to apply for daily allowance for an unpaid day without scheduled work shifts, because working hours were not shortened and no salary was lost due to a lay-off. But if you had a paid day without scheduled work shifts in your shift calendar and you lose your salary for the day due to a lay-off, such a day should be entered in your application as an unemployed day. An incorrectly filled out application may be returned to you for revision.

If the lay-off takes the form of shortened daily working hours, you must report your actual working hours in your application. The application should be filled out for four full calendar weeks or for a month, whichever accurately reflects your salary periods. In the application, enter both workdays and working hours completed during those workdays. If you have been working shifts, the application must include both paid and unpaid days for which no shifts were scheduled, because any days listed as unpaid days in your shift calendar are not considered lay-off days. You should also report any midweek holidays if you have received midweek holiday compensation for them or if your salary was not subject to midweek holiday salary reduction due to your lay-off.

The salary income you receive for your shortened workday lay-off impacts your earnings-related allowance based on the time the salary is actually paid to you. This is called payment-based adjustment of daily allowance.

Earnings-related unemployment allowance can be paid for midweek holidays (arkipyhä) during a temporary lay-off on the same grounds as other days of lay-off, if you are not entitled to full pay for the midweek holiday.

Different sectors have different practices for compensating employees for midweek holidays:

- separate midweek holiday compensation

- no separate compensation, but a midweek holiday during a workweek does not reduce the amount of salary paid

- midweek holidays reduce the amount of salary paid

Entering paid absences in the application

In case of paid absences, please also enter the hours your salary will be paid for when you complete the application. For example, if you are on sick leave and getting paid during the leave, write down “sick” on those days when you complete the application. Please also enter the working hours your sick leave pay will be paid for.

This information is essential and importation for the Fund, so that we can see the number of hours for which pay has been given during the paid absence and determine whether your working hours fall below the threshold for earnings-related allowance. Paid absence may include, for example, sick leaves, annual leaves, midweek holidays, worktime shortenings, flextime holidays, and compensatory time-offs, or similar.

Detailed instructions if you do part-time or occasional work.

Register at Job Market Finland as an unemployed jobseeker

Notify the employment authority if you have started a part-time job, a business or are doing occasional work.

You can apply for an adjusted daily allowance as well as an earnings-related daily allowance in other ways.

Apply online for an earnings-related unemployment allowance in our eService.

- Fill in the application according to the salary period for the work, that is, in periods of four calendar weeks or calendar months.

- If you have already applied for a daily allowance before, continue applying in the same intervals. We will change the application period if necessary

- of all employment relationships which are valid during the application period or if an employment relationship is missing information

- if the employment relationship shows in the Incomes Register data it does not need to be filled in again

- if you occasionally do gig work for the same employer, the employment relationship does not need to be filled in for each gig separately

- days and working hours during which you worked. If you worked for more than one employer specify each job in the day’s notes section

- hours worked as an entrepreneur do not need to be filled in.

- in case the Incomes Register data is not accurate.

- We retrieve application-related data from the Incomes Register. You will see it when filling in the application. If the data is incomplete, you can provide additional information.

Attach the following to your application:

- A copy of your employment contract after you started working.

- You do not need to send a payslip; we will receive your salary data directly from the Incomes Register. However, if the Incomes Register data is incomplete, we will ask you, for example, for a payslip.

- If, on the other hand, you receive income from business activities during the application period, please provide us with a salary statement.

You can send an application even if all attachments are not yet available. Send them to us as soon as you receive them.

Send the application and its attachments via eService. You can submit the application at the end of the application period

You can send a paper application form to:

Avoin työttömyyskassa

PL 116

00531 Helsinki

Remember that the application must have been received by us no later than three months from the first day of the application period.

Our processor will contact you if we need more information in order to process your application. Please submit any missing attachments or additional clarifications we have requested through our eServices.

Remember to notify us of any changes affecting your entitlement to daily allowance and any changes in your personal and contact information through eServices.

Changes affecting the daily allowance

Notify us promptly of any changes affecting your entitlement to daily allowance and the payment of daily allowance in your situation. You should also keep your information up-to-date for the processing of your application. You can report changes through eServices, or by post. You can also provide some of the information by calling our service number.

Child home care allowance

If you or your spouse are paid child home care allowance, please indicate this in the application. If your spouse receives child home care allowance, include more detailed information on your spouse’s possible employment and studies and on the person caring for the child. You should also notify us of any changes in child home care allowance or the discontinuation of the allowance. Decisions on child home care allowance do not need to be sent to us.

End of employment

If your employment ends, notify us of this in your daily allowance application and to the employment authority.

End of unemployment

Please notify us in your application if you no longer apply for daily allowance in the future. If you start full-time employment lasting more than two weeks, notify the employment authority. Also notify us of the start of employment with your latest daily allowance application.

Old-age pension or other benefits

If you retire on an old-age pension or have been granted another benefit that prevents you from receiving the daily allowance, please notify us at the latest in connection with your last application for a daily allowance. If you wish, you can retire on an old-age pension already after the age of 62, if you have been paid a daily allowance for additional days.

You will need a certificate for the pension company from the fund about the additional days paid. Ask for a certificate when you are applying for a daily allowance for the month before your pension. We cannot write the certificate earlier, because the pension company needs information about the additional days of the month preceding the pension.

Partial disability pension

Send the decision on granting the pension to us either through eServices or by post. You do not need to send a new decision annually on the size of the pension resulting from indexation. The data is submitted to us directly from the Incomes Register. If you receive a partial early old-age pension, the decision on granting the pension does not need to be sent to us. A partial early old-age pension does not affect the payment of an earnings-related daily allowance.

Illness

If you fall ill and your illness lasts more than ten days, you can claim sickness allowance from Kela. Report your illness via an application. Also indicate on the application whether you have claimed sickness allowance from Kela. The waiting period for qualifying for sickness allowance is the first day of illness plus the following nine days (including Saturdays). In the event of an accident or the same illness within 30 days, the waiting period is one day.

We can pay an earnings-related daily allowance for the waiting period of the sickness allowance if you have received unemployment benefit just before the illness. Read more about falling ill during unemployment here.

Changes in personal information

Account number

You can provide a new account number in eServices, notify it in your application or send it in writing by post. You cannot provide a new account number over the phone.

Contact details

You can notify us of a change of address or a new phone number in eServices, by entering the information in the additional information section of the follow-up application or by calling the service number.

In order for earnings-related daily allowance to be paid, it must be applied for. An application for earnings-related daily allowance is always submitted retroactively, meaning for a past period. The retroactive application period is 3 months and is calculated backwards from the date the application is received by the fund. The retroactive application period applies to both the first application and subsequent applications.

Example: If you become unemployed on 1 January, the application must be received by the fund no later than 1 April.

Earnings-related daily allowance cannot be granted retroactively for more than three months without a particularly weighty reason. Forgetfulness or lack of information is generally not considered a particularly weighty reason.

In the event of a weather barrier, you can apply for a daily allowance from the fund under certain conditions.

If work is prevented due to freezing temperatures, those working in the building and forestry industry must have agreed on a frost limit before starting work on the site.

Follow these instructions if you are applying for daily allowance due to a weather barrier

Submit the application no earlier than after two full calendar weeks (Mon–Sun) from the start of the unpaid weather barrier. If the weather barrier lasts less than two weeks in total, submit one application covering the entire duration of the weather barrier.

If the unpaid weather barrier

- starts on a Monday, complete the first application for two full calendar weeks from Monday to Sunday.

- starts in the middle of the week, complete the first application up to the end of that week and additionally for two full calendar weeks from Monday to Sunday.

In the daily breakdown of the application, select “other reason” and enter “weather barrier” as the explanation.

.

If the weather barrier continues for an indefinite period, submit further applications covering four calendar weeks (Mon–Sun). If the weather barrier lasts no more than four weeks, submit the further application up to the date on which the weather barrier ends.

You can submit the application no earlier than on the last day of the application period.

The daily allowance must be applied for no later than three months from the first day of the period applied for.

Example: You are unpaid due to a weather barrier from 1 February to 15 February and want to apply for a daily allowance for that period. In this case, the application must reach the fund no later than 1 May.

Attach supporting documents to the application, such as a certificate from the employer listing the unpaid days due to the weather barrier. You may also submit the application even if you do not yet have all the attachments available. You can indicate in the additional information section of the application if you intend to submit the attachments later. We will process the application as soon as we have received all the required information.

If we need additional information to process your application, we will contact you.

If your work is interrupted due to industrial action in another sector, you may be entitled to an earnings-related daily allowance. Such a situation is referred to as jalkautus, i.e. a situation caused by secondary industrial action.

Read more about the effects of strikes and jalkautus here.

If you are applying for a daily allowance in this case, follow these steps:

- Activate your job-seeking in the E-services at Job Market Finland so that you can apply for a daily allowance

- Notify the employment authority of the prevention of your work during the industrial action (i.e. strike) taken by another group of employees or the employer

- Apply for daily allowance from the day after the end of salary payment

- In your application, announce until when the employer will pay you a salary

When your sick leave is prolonged and you are in the following situation:

- The maximum period of sickness allowance from Kela has been exhausted. This period consists of no more than 300 working days, which is equivalent to approximately one year.

- Your employment relationship remains in effect.

- Your incapacity for work continues.

Do the following:

- Register at the employment authority as a jobseeker looking for full-time work, within your capacity for work. Register as soon as you receive Kela’s decision on the exhaustion of the maximum period for sickness allowance.

- Apply for full disability pension from Kela or from a pension provider.

You must apply for the full disability pension. It is not sufficient to apply for some other pension or benefit, such as a partial disability pension.

- You apply for earnings-related allowance from the unemployment fund when you have been an unemployed jobseeker for at least two weeks.

Declare the disability pension you have applied for on your earnings-related allowance application. Also state the name of the pension provider to whom the application was submitted. When you receive a decision on the disability pension, submit it to the fund immediately.

Include the following appendices with your earnings-related allowance application:

- statement from your employer verifying that they are unable to provide work suitable for your current capacity for work

- valid medical certificate

- decision on the disability pension as soon as you receive it

Attach to your application:

- Inform us of the start and total duration of your grant work, for example in the additional information section of the daily allowance application or in a message via our eService.

- Do not report grant work in the application as an employment relationship or as working days.

- Provide us with a copy of the grant decision.

Grant work does not accrue your employment condition. If you are also working in paid employment alongside the grant, the paid work will accrue the employment condition as usual.

You can apply for mobility allowance if you accept a job or a training position that is a prerequisite for work, which is at a long distance from your home. The allowance helps compensate for costs stemming from the long commute or the move to another locality.

Mobility allowance is paid out only if you are an unemployed jobseeker and entitled to earnings-related allowance before the work or training starts. The duration of the employment relationship and the length of the commute are also subject to conditions. All conditions related to mobility allowance are available here.

If you are applying for mobility allowance, do the following:

1. Check the conditions for mobility allowance payments

2. Fill out a mobility allowance application. No signature is needed if the application is submitted via eService, i.e. using strong identification.

3. Store or print the application as a PDF on your device.

4. Sign in to eService. Submit your application in the Appendices section. Select ‘mobility allowance application’ as the document type.

5. Attach your employment contract or a statement on your training.

6. Notify the fund if your situation changes.

Please also note the following when you are applying for mobility allowance:

While you can apply for the allowance immediately after you have agreed to take on the job, the application is processed no sooner than two weeks after the start of your employment or training. Submit the application no later than three months after the start of your employment or training.

Employment details

Fill out the application form with the details of your new job. Employer and employment information will be used to determine your eligibility for mobility allowance, so fill out the application form carefully. Enter the start date and the possible end date of your employment in the form. Your working hours are crucial for determining your eligibility for benefits, so please specify your agreed working hours in the application.

If the employment contract has not been made in writing, you can also submit another statement concerning the details of your employment. You can also submit the employment contract or the statement at a later date.

Commute

You will be asked to provide information on the duration of your commute. Enter the average duration of your commute using public transport under normal weather and traffic conditions. If you do not have a car, verify your commuting time via public transport, accounting for any transfers. Only report the time spent commuting to work. For instance, taking your children to daycare is not part of your commute.

Social benefits

Also report your other social security benefits on the application form. For example, sickness allowance, disability pension and parental allowance will disqualify you for mobility allowance for the same period.

Notify the fund of any changes in your employment relationship, such as when your employment ends prematurely, you are laid off, or work and salary payments are suspended due to some other reason. The changes can be reported with the same application form you use to apply for the benefit.

A single application is used to apply for mobility allowance for the entire benefit period, regardless of whether the work is full-time or part-time.

For part-time work, we can only process your application for mobility allowance once we have received a report of your actual working days.

If working part-time, you may apply for both adjusted earnings-related allowance and mobility allowance for the same period. In this case, we will obtain the details of your working days from your earnings-related allowance application.

If you do not apply for adjusted daily allowance for the period of part-time work, submit a statement of the days worked during the allowance period after the fact to enable payment of the mobility allowance.

The restructuring protection allowance is a one-time financial compensation designed to support your re-employment if you are terminated after the age of 55, following at least five years of continuous service with the same employer.

Apply for restructuring protection allowance from the unemployment fund you were a member of at the time of your termination. If you are a member of A-kassa, submit the application to us. If you are not a member of any unemployment fund, apply for restructuring protection allowance from Kela. The amount of the restructuring protection allowance is the same, regardless of whether it is paid by Kela or an unemployment fund.

You can receive restructuring protection allowance from us, even if your fund membership started just before your termination. In other words, the 12-month membership and employment condition required for earnings-related allowance does not apply to restructuring protection allowance.

If you are applying for restructuring protection allowance, do the following:

1. Review all the conditions for paying out restructuring protection allowance.

2. Register as a jobseeker at Job Market Finland immediately or no later than 60 days from the day of termination. The employment authority provides the fund with a statement regarding your eligibility for restructuring protection allowance.

3. Once the statement has reached the fund, a restructuring protection allowance application is displayed in eService, on the application tab. Fill out and submit the application. The application can be filled out as early as during the period of notice and no later than 3 months from the end of the employment relationship. Include any appendices you may have to your application.

4. Provide a revised tax card for benefits to ensure that your withholding rate is in accordance with the revised tax card. If you do not provide a revised tax card for benefits, your withholding rate is determined based on the additional rate on your salary tax card.

5. Notify the fund if your situation changes during the period of notice.

If you are not able to use the eService, you can also print out the application form and mail it to the fund to the following address: Open Unemployment Fund, P.O. Box 116, FI-00531 Helsinki.

Please also note the following:

- If you have not received a statement, request one from the employment authority.

- Notify the fund if your employment relationship ends during the period of notice or if your termination is cancelled.

- Restructuring protection allowance does not disqualify anyone from receiving earnings-related allowance nor does it reduce the amount of the earnings-related allowance.

- The restructuring protection allowance can be paid even if you are immediately re-employed by another employer.