Key laws and regulations:

Our partners

The Open Unemployment Fund works in partnership with several trade unions and most of our members belong to a trade union. Trade unions are on the side of the worker and bring security to working life.

Operation and financing of the unemployment fund

Unemployment funds perform a public duty and are governed by laws. The most important legislation affecting the operations of unemployment funds are the Unemployment Funds Act and the Unemployment Security Act. The unemployment funds are also subject to the many laws that govern the activities of public authorities.

All unemployment funds are subject to the same laws and regulations.

How are the operations of an unemployment fund regulated?

The Ministry of Social Affairs and Health issues instructions on the application of legislation to unemployment funds. Any changes to the laws governing unemployment funds are also mainly prepared by the Ministry of Social Affairs and Health or the Ministry of Economic Affairs and Employment.

In turn, the Financial Supervisory Authority monitors the activities of the funds. This monitoring includes, for example, the implementation of unemployment security, the operational measures of the funds, their financial status, and management, control, and risk management methods.

How are the benefits paid by unemployment funds financed?

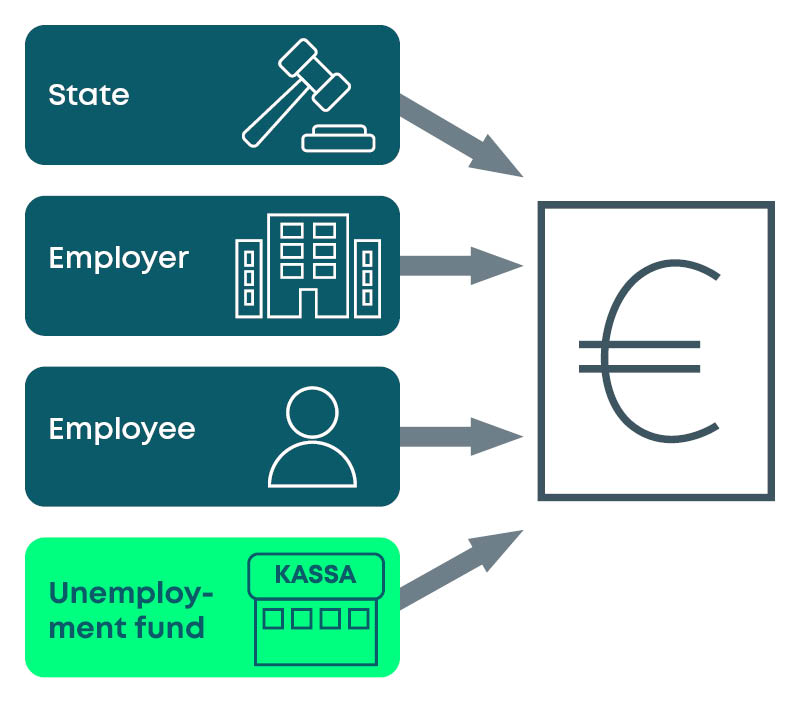

The earnings-related part of the earnings-related unemployment allowance is financed in full by the fund’s members and employers. The State finances an amount corresponding to basic unemployment allowance or labour market subsidy from earnings-related security.

The State pays an amount corresponding to the basic unemployment allowance and the unemployment fund 5.5% of the earnings-related security expenses paid by the employee fund. The rest of the earnings-related security expenditure is paid by the Employment Fund.

As an exception to the general rule, the State does not finance the benefit paid for additional days or lay-off periods, but the Employment Fund’s share of these expenses is 94.5%.

Financing of the earnings-related part of the daily allowance

The earnings-related part of the daily allowance paid by the unemployment fund is financed by the employers’ unemployment insurance contributions and unemployment insurance contributions and membership fees paid by fund members.

Neither the State nor persons who are not members in the fund participate in the financing of the earnings-related part of the daily allowance at all.

Do non-fund members finance earnings-related allowances?

Those who are not members in the fund must also pay an unemployment insurance contribution. However, this contribution does not finance earnings-related security, but is used to finance basic unemployment security. Unemployment insurance contributions are paid to Kela, and the basic unemployment allowance is financed in its entirety by insurance contributions.

What is financed by unemployment insurance contributions?

In addition to earnings-related unemployment allowance and basic unemployment allowance, the unemployment insurance contribution is used to finance pensions, adult education and wage security.

How will the payment of benefits be secured?

In order to secure financing and liquidity, an unemployment fund must have a countervailing fund, the minimum and maximum amounts of which are confirmed by the Financial Supervisory Authority.

Meeting the shortfall

If the financial statements of the unemployment fund show that the expenditure has been higher than the income, the difference will be taken from the unemployment fund’s countervailing funds. If their countervailing funds are not enough, the Finnish Employment Funds support fund covers the shortfall. Ultimately, if these funds are insufficient, the State will grant an additional contribution to the unemployment fund. This ensures that the members of the unemployment funds receive their payments under all circumstances. Open Unemployment Fund (A-kassa) has never had to rely on the support fund of unemployment funds.

Read more about TYJ: https://www.tyj.fi/en/