Programme of Prime Minister Petteri Orpo’s Government was published on 16 June 2023 and as expected, it also included many changes to earnings-related security. The law will not change immediately, and the amendments will need to undergo legislative drafting before entering into force. Not all the stated policies will necessarily be implemented as entered in the Government Programme.

The changes that will come into effect on 1 January 2024:

Changes that will come into effect on 1 April 2024:

Changes that will come into effect on 1 August 2024:

Changes that will come into effect on 2 September 2024:

Changes that will come into effect on 1 January 2025:

We will update the information below as soon as the content and effective dates of the legal changes are confirmed.

Government Programme entries on earnings-related security

You can find more detailed information about the planned changes in the link for each point.

1. The amount of earnings-related daily allowance will be staggered

2. Child increments will be abolished

3. The employment condition will be extended to 12 months

4. The employment condition will be linked to euros earned

5. The qualifying period will increase to seven days

6. Periodisation of holiday compensation will be reintroduced

7. The protected part for part-time workers will be abolished

8. Age-related exemption rules for unemployment security to be abolished

9. Report on the development of income security

10. The job alternation leave system will be abolished

11. Possible combined insurance

12. Unemployment funds will be allowed to offer employment services to their customers

13. The employment condition accrue from pay subsidy work

14. Supplementary amount removed

In June 19, 2024, the Parliament of Finland approved the government proposal on staggering the level of earnings-related allowance. In practice, this means that earnings-related allowance payouts decrease as unemployment continues. Staggering of earnings-related allowance enters into force on September 2, 2024. Both the first and the second staggering are calculated from the full earnings-related allowance.

| Full earnings-related allowance for first 40 days | 1st staggering, 41–170 days |

2nd staggering, 171 days |

| 100 % | 80 % | 75 % |

In the future, staggering applies to all recipients of earnings-related allowance, including those who are on an extension, working part-time or receiving entrepreneur’s daily allowance.

However, the change does not impact allowance periods that have begun before September. Rather, the staggering only applies to benefits that are paid out after September 2, 2024 in accordance with the new 12-month employment condition. If your employment condition has been fulfilled by September 1, 2024 and your daily allowance is based on the old 26-week employment condition, the staggering is not applied.

An example where staggering does not apply:

If you have fulfilled your employment condition and your daily allowance amount has been calculated in August 2024 or earlier, the staggering does not apply to you until you fulfill the employment condition again and the daily allowance is determined based on a 12-month employment condition.

An example where staggering applies:

If your allowance period starts in September or later and your employment condition has been fulfilled based on the new 12-month employment condition, the staggering applies to you.

In practice, the change starts to affect benefits in November at the earliest. The first members under the staggering framework have then accrued 40 unemployment days, i.e. approximately two months. Those working part-time will see the impact of the staggering a little later, as their allowance period days are accrued slower.

The full, non-staggered earnings-related allowance can be received again when the recipient has again fulfilled the employment condition for wage earner or entrepreneur. In practice, this means that between periods of unemployment, wage income in accordance with the working condition has been accumulated for at least 12 calendar months.

The earnings-related allowance is usually bigger than the basic unemployment allowance by Kela, even after the staggering.

Example:

Effect per month: The average monthly salary before unemployment or layoff is €2,500 for the period fulfilling the employment condition.

Monthly salary Earnings-related allowance ⇒ 2 months Earnings-related allowance 2-8 months Earnings-related allowance 8 months ⇒ € 2,500/month € 1,515/month € 1,212/month € 1,136/month € -303/month € -379/month

Effect per month: The average monthly salary before unemployment or layoff is €3,000/month for the period fulfilling the employment condition.

Monthly salary Earnings-related allowance ⇒ 2 months Earnings-related allowance 2-8 months Earnings-related allowance 8 months ⇒ € 3,000/month € 1,730/month € 1,384/month € 1,298/month € -346/month €-432/month

The law change has been approved, will enter into force on September 2, 2024.

Until April 1, 2024, it was possible to receive a child increase for children under the age of 18. in 2024, the amount of the child increment was EUR 5.84 per day for one child, EUR 8.57 for two children and a total of EUR 11.05 for three or more children.

In 2023, an additional increase was made to the child increment of the unemployment security, which was removed at the beginning of 2024. Due to the removal of the increment the child increment decreased by 25–48 euros per month, depending on the number of children.

The Government’s legislative change to remove the child increment completely took effect on 1 April 2024. This means that the unemployment benefits paid after the beginning of April will not include any child increments. The removal of the child increment will reduce the amount of the daily unemployment allowance by EUR 125–240 per month.

The Government has also decided to freeze the index increase of the unemployment security for the years 2024–2027. As a result, the child increment did not receive the usual index increase at the beginning of the year.

Effect per month:

Child increment according to the number of children in 2024 The increase is omitted, impact/monthOne child: EUR 5.84 per day EUR -150.71 per month Two children: EUR 8.57 per day EUR -221.23 per month Three children: EUR 11.05 per day EUR -285.09 per month

The law change has been approved, entered into force on April 1, 2024.

Employment condition until 1.9.2024: The employment condition is met when the member has been in paid employment for at least 26 calendar weeks during the 28 months immediately before unemployment. At the weekly level, the employment condition is met when the member works as least 18 hours during the calendar week and their pay is in accordance with the collective agreement.

Employment condition from 2.9.2024: The employment condition is met when the member has been paid at least 12 months of salary income of 930 euros/month during the 28 months preceding the unemployment.

The 28-month review period can be extended by a maximum of 7 years due to, for example, illness, full-time studies, care for a child up to the age of three or another acceptable reason comparable to these.

The law change has been approved, will enter into force in September 2024.

Employment condition is the required duration of employment while being a member of an unemployment fund before becoming entitled to earnings-related allowance for unemployment or layoff. Currently, the employment condition accrues on the basis of working hours. After the change in the law, the employment condition will be linked to euros earned.

Euro-based employment condition means that entitlement to earnings-related allowance is based on specific earned income (gross), paid out during a calendar month. Only this kind of salary for insurance purposes accrues the employment condition. For instance, holiday compensation and holiday bonus are excluded.

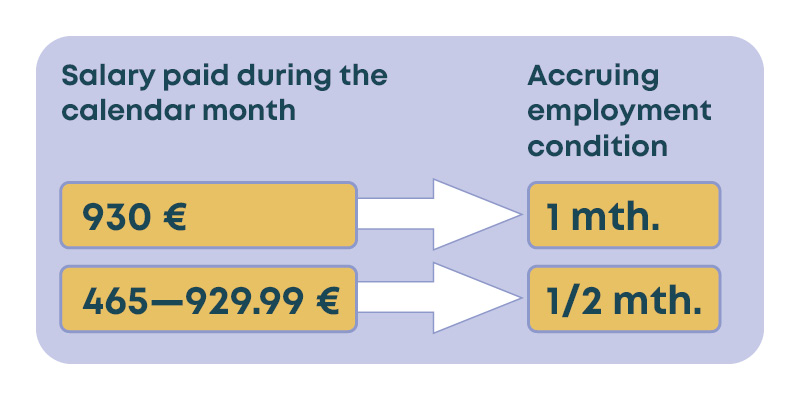

Employment condition will accrue as follows:

You need a total of 12 paid calendar months of employment condition accrued during a 28-month reference period. If the accrued employment condition consists only of half months, you need a total of 24 paid calendar months.

The euro-based employment condition is applied starting on September 2, 2024. You are under the 12-month euro-based employment condition when you again meet your employment condition and your employment condition includes salary that has been earned and paid after September 2, 2024.

Calendar months that predate September 2, 2024 but are included in determining the employment condition are converted to employment condition months in accordance with the new stipulation. In practice, 1–2 employment condition weeks and the salary earned during that time is converted to one half of an employment condition month, while 3–4 employment condition weeks and the salary earned during that time is converted to one full employment condition month.

With this legislative amendment, the fund’s membership condition likewise extends to 12 months.

Examples of how monetary valuation affects employment condition

How are employment condition weeks that are completed before September 1, 2024 calculated for the 12-month employment condition?

Example 1:

An applicant has accumulated 22 working-time-based employment condition weeks by September 1, 2024. Since the employment condition has not been fulfilled and the applicant is not yet entitled to daily allowance, their case is processed in accordance with regulations of the 12-month euro-based employment condition.

Under the euro-based employment condition, 22 employment condition weeks completed by September 1, 2024 equal 5.5 employment condition months.

Fulfilling the 12-month employment condition would require the applicant to accumulate another 6.5 euro-based employment condition months. In practice, this means that starting September 2, 2024, they must receive at least 930 euros in work-based salary, excluding any holiday compensation or a holiday bonus, during a period of 6 calendar months (6 employment condition months) and at least 465 euros during one calendar month (½ employment condition month).

Example 2:

If an applicant has accumulated 18 employment condition weeks during the period of Jan 1 - Sept 1, 2024, it equals 18 / 4 = 4.5 employment condition months. The employment condition is fulfilled if the applicant also receives at least 930 euros in work-based salary during 7 calendar months (excluding any holiday compensation or a holiday bonus) and at least 465 euros during one calendar month after September 2, 2024.

The law change has been approved, will enter into force in September 2024.

Unemployment benefits are only paid after the qualifying period. Previously, the qualifying period was five working days, and after the change in the law that entered into force on January 1, 2024, it is now seven days.

Effect per month: approx. € 150 (2 x the amount of your daily allowance)

The law change has been approved, will enter into force on January 1, 2024.

In future, annual holidays not taken by the end of the employment relationship will postpone the start of earnings-related unemployment allowance payments by as many days as the holiday compensation paid corresponds to the average salary for the number of working days.

The periodisation applies to full-time employment that has lasted more than two weeks and has ended. Holiday compensation paid for part-time employment are not periodised but are adjusted when the daily allowance is paid.

The periodisation of holiday compensation does not affect lay-offs, because then the employment relationship does not end completely.

For example, if you are paid a holiday compensation equivalent to a month’s wages when your employment ends, it is possible to start accruing the waiting period and pay the unemployment benefit only when this paid period ends, in this case, after about a month.

Example of periodization:

The person's full-time employment, which lasted more than two weeks, has ended on January 31, 2024. At the end of his employment, he has been paid 1,500 euros in holiday compensation for annual leave that he has not taken.

His average monthly salary has been 3,000 euros and his daily salary 3,000 euros: 21.5 days = 139.53 euros/day.

The holiday compensation is divided by the average daily wage of 1,500 euros: 139.53 euros/day = 10 days.

10 payable days, i.e., two weeks from the end of the employment relationship, are used for the periodisation of holiday compensation.

Earnings-related daily allowance cannot be paid from 1 February to 14 February 2024. After the period, the waiting period is taken into account, which is seven days, i.e. starting on February 15, 2024 and lasting until February 25, 2024.

The payment of the earnings-related daily allowance can therefore start on 26 February 2024.

The law change has been approved, entered into force on January 1, 2024.

The protected part of earnings was the amount of money you could earn without affecting the amount of earnings-related daily allowance. The protected part of earnings was implemented in the beginning of 2014. For part-time work, it has since remained at the maximum of 300 euros for a one-month application period and 279 euros for an application period of four consecutive weeks. The protected part was deducted from earnings before tax, i.e. from gross income.

At the beginning of April, a legislative amendment by the Government came into force, which completely removed the protected part of earnings. The new legislation applies to adjusted daily allowance for application periods starting April 1, 2024 or later. From that date forward, the protected part of earnings will no longer be used when calculating adjusted earnings-related allowances. In other words, the removal of the protected part decreases the size of the adjusted earnings-related allowance.

Effect per month:

2023 calculations

For an applicant with a monthly salary of €2,500, the full daily allowance is €70.48/day

Monthly salary € 2,500/month Salary for part-time work € 1,400/month Protected part of earnings € 300/month Remaining salary € 1,100/month 50% of the remaining salary affects the daily allowance € 550/month The remaining 50% is divided by the number of days worked during the application period 21.5 days/month Sum deducted from applicant’s full daily allowance € 25.58/day

Full earnings-related allowance/day Adjusted earnings-related allowance/day Adjusted earnings-related allowance /month € 70.48/day € 44.90/day € 965.35/month

2024 calculations

For an applicant with a monthly salary of €2,500, the full daily allowance is €70.48/day

Monthly salary € 2,500/month Salary for part-time work € 1,400/month Protected part of earnings Remaining salary 50% of the remaining salary affects the daily allowance € 700/month The remaining 50% is divided by the number of days worked during the application period Sum deducted from applicant’s full daily allowance € 32.55/day

Full earnings-related allowance/day Adjusted earnings-related allowance/day Adjusted earnings-related allowance /month € 70.48/day € 37.93/day € 815.49/month

Decrease in adjusted daily allowance following the law reform € -149.86/month

The law change has been approved, entered into force on January 1, 2024.

The age-related exemption rules are also abolished. Wage-earners’ employment condition is not accrued by such rehabilitation, training or work opportunities that the municipality is obliged to provide to an unemployed jobseeker who fulfils age-related provisions and whose right to a wage earner’s daily allowance is ending.

Protective regulations concerning the amount of daily allowance, as related to these age-related exemption rules, are also no longer valid.

What’s more, the protective regulation concerning those who are at least 58 years old will also be abolished. Previously, this regulation stipulated that the earnings-related allowance cannot be decreased for persons who fulfil the employment condition after turning 58.

The law change has been approved, will enter into force on September 2, 2024.

According to the Government Programme, the Government will examine a model for transitioning to universal earnings-related security.by the mid-term policy review. Universal earnings-related security means a model where all wage earners would be entitled to earnings-related daily allowance regardless of whether they belong to an unemployment fund.

We do not yet have details on this, but we will follow how this progresses.

The Parliament has approved the amendment to the law, which abolishes the alternation leave system. The law enters into force on August 1. You can start alternation leave until the last day of July, after that it is no longer possible.

Job alternation leave has enabled employees to take a break from work and, correspondingly, offered unemployed jobseekers an employment opportunity for the duration of the job alternation leave.

The job alternation leave can still start on July 31, 2024. The job alternation leave that starts in July can continue for the maximum number of 180 calendar days.

For the job alternation leave to be considered to have started by 31 July 2024, the job alternation agreement must be submitted to the TE Office and the start date of the employment contract replacing the alternation leave must be no later than 31 July 2024.

The job alternation leave system will be abolished on August 1, 2024.

On June 18, 2024, the Parliament of Finland approved a legislative amendment allowing unemployment funds to expand their role. With the amendment in force, funds will be able to offer employment services to their members. Such services may include employment services, counselling and help in finding employment as well as various coaching services.

In principle, pay subsidy work no longer counts towards fulfilling the employment condition after September. There is an exception: pay subsidy work of disadvantaged and disabled workers or the long-term unemployed aged over 60. In these cases, pay subsidy work counts towards fulfilling the employment condition but only after the first 10 months have passed. The employment condition calculation takes into consideration 75% of the months that count towards fulfilling the employment condition.

The law change has been approved, will enter into force on September 2, 2024.

Currently, the supplementary amount is payable with earnings-related allowance if the unemployed person participates in a service promoting employment. Recently, the government decided in its session on spending limits that the supplementary amount will be removed on January 1, 2025.

The supplementary amount is available for a maximum of 200 days. To be entitled to the benefit, your employment plan with the TE Office or the municipality participating in the local government pilot must include an agreement to participate in a service promoting employment. In 2024, the supplementary amount is 5.29 euros per day.

In 2023, A-kassa paid the supplementary amount to 4,164 recipients. Removal of the supplementary amount typically impacts earnings-related allowance by 60 to 210 euros a month.

We will provide details on the implementation of the amendment as soon as we receive more information.

Postal address:

Hakaniemenranta 1

PL 116, 00531 Helsinki