The types and forms of work have become more diverse. More people are doing jobs with varying working hours, and some work without an employment relationship. As new technologies arise, they are introducing entirely new types of work. Nevertheless, a lot of work is still done full-time in employment relationships with fixed working hours and places of work.

In today’s diverse working life, unemployment benefits should contribute to the fundamental goal of earnings-related unemployment security: getting jobseekers back onto the labour market quickly. Unemployment security should be sufficient for people to make ends meet. However, the hot topic at the moment is how security should be arranged to encourage people to seek full-time work.

In the unemployment security system, the aim is to find full-time employment as quickly as possible. Part-time work can be a stepping stone between unemployment and full-time work. If it is difficult to find full-time work, part-time work can keep people in working life and ease the transition between jobs. The earnings-related unemployment security system is currently designed to encourage jobseekers to accept part-time and occasional work during unemployment. In many sectors, part-time work may be more the rule rather than the exception. The protected part of the adjusted daily allowance – the amount of earned income that is not deducted from the earnings-related unemployment allowance – incentivises people to accept work. The protected part is EUR 300 per month. For every euro earned over this amount, fifty cents is deducted from the daily allowance. If the reform envisaged by Petteri Orpo’s government is implemented as planned, the protected part will be removed.

What is part-time work?

In unemployment security, part-time work is work in an employment relationship where the working hours agreed in the employment contract do not exceed 80% of the maximum working hours of a full-time employee in the industry.

A part-time worker may receive an adjusted daily allowance under the following conditions:

- The work is part-time, and the working hours do not exceed 80% of full-time working hours

- The daily working time has been reduced due to a temporary lay-off

- Periods of full-time work last no longer than two weeks

- Part-time self-employment

- Full-time self-employment for no longer than two weeks

- The part-time work is not based on the employee’s own need to reduce their working time

Occasional work is work lasting no longer than two weeks on a full-time basis. In this case, the worker is entitled to an adjusted daily allowance. Temporary work usually refers to a fixed-term employment relationship. Fixed-term employment may be full-time or part-time.

Zero-hour contracts and other contracts where the working time is variable rather than fixed (for example, 0–40 hours per week or 10–30 hours per week) and contracts where the employee is called in when needed are referred to as variable working time contracts. Employees may request variable working time employment contracts while studying, for example, or if they otherwise prefer such an arrangement. Conversely, employers may only offer such contracts if the workload genuinely fluctuates.

Employees who have chosen to reduce their working time are not entitled to unemployment security.

An employee may receive an adjusted unemployment benefit while on a zero-hour contract if only a small amount of work is available. The unpaid waiting period does not apply if a zero-hour contract is terminated, provided that the employee resigns and no more than 18 hours of work was normally available in each of the preceding 12 weeks.

How does partial working affect the earnings-related daily allowance?

If the income during unemployment is less than the protected part, the income does not affect the amount of the daily allowance paid. For adjusted daily allowances, the protected part is EUR 300 per month or EUR 279 in the adjustment period of four calendar weeks. As a general rule, 50% of the income exceeding the protected part is deducted from the earnings-related unemployment allowance. However, the combined wages and adjusted daily allowance may not exceed the wages on which the daily allowance is based. However, the adjusted earnings-related unemployment allowance is paid in the same amount as the adjusted basic unemployment allowance that the person would be entitled to receive.

Example:

Kay’s full earnings-related unemployment allowance = EUR 60 per day

She takes on part-time work and is paid EUR 600 per month

(The salary is paid monthly, so the application period for the earnings-related unemployment allowance is one calendar month.)

The protected part is EUR 300 per month

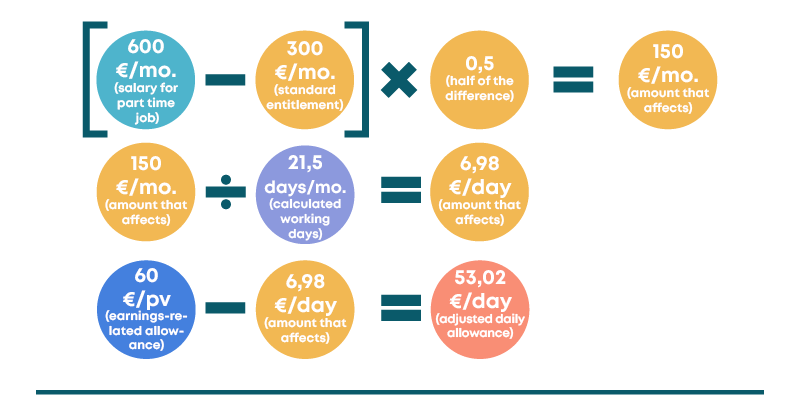

Half of the salary exceeding the protected part of her income affects the amount of earnings-related unemployment allowance:

(EUR 600 per month – EUR 300 per month) x 0.5 = EUR 150 per month

To obtain the amount per day, divide the above amount by the number of working days in the month:

EUR 150 per month ÷ 21.5 days per month = EUR 6.98 per day.

Therefore, the adjusted daily allowance is EUR 60 per day – EUR 6.98 per day = EUR 53.02 per day

The adjusted daily allowance is paid for every working day during the adjustment period.

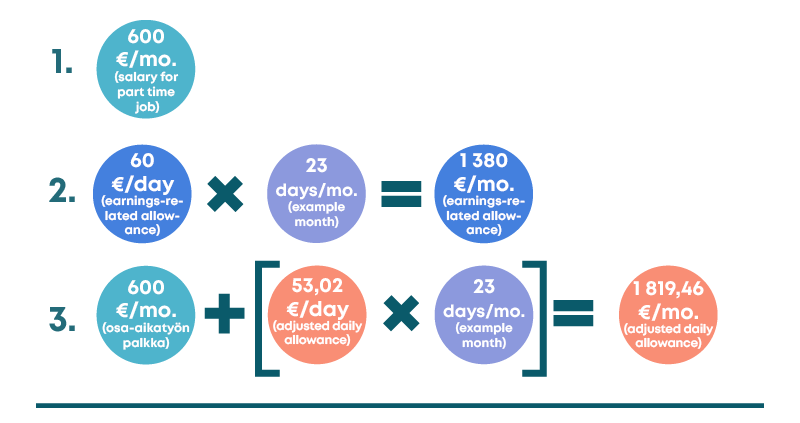

There are 23 working days in the example month, so Kay’s options are as follows (excluding taxes):

- Salary if she chooses not to apply for an earnings-related unemployment allowance: EUR 600/month

- Earnings-related unemployment allowance if she does not take on part-time work: EUR 60.00 per day x 23 days = EUR 1,380 per month

- Salary + earnings-related unemployment allowance if she applies for an adjusted allowance:

EUR 600 per month + (EUR 53.02 per day x 23 days) = EUR 1,819.46 per month

The amount of the adjusted earnings-related unemployment allowance varies from month to month, depending on how much work the person does and how much they earn. If the person exceeds the 80% working hour limit for an adjusted daily allowance, no benefit is paid. In months when the working hour limit is not surpassed, the salary and earnings-related unemployment allowance are reconciled. In other words, the person receives their earned income for the part-time work and an earnings-related unemployment allowance adjusted according to the salary or wage.

Adjusted daily allowances are paid on a cash basis. This means that your earned income during unemployment affects your earnings-related unemployment allowance if the remuneration is actually paid to you. The adjusted daily allowance is also paid for the days you worked during the application period. You can calculate an indicative estimate of the amount of the adjusted daily allowance using the daily allowance calculator.

If you are paid an adjusted daily allowance, the days accumulate towards the maximum time calculation more slowly than if you received a full daily allowance. When the maximum payment period is calculated, the amount paid as adjusted daily allowances is converted into full days of earnings-related unemployment allowance. The amount of the full and adjusted daily allowances affects how days accrue towards the maximum period when the adjusted daily allowance is paid.

Orpo’s government plans to remove the protected part of the adjusted daily allowance. This would mean that in the future, all income earned while unemployed would be deducted from the payable amount of the earnings-related unemployment allowance, and people who earn more than EUR 300 per month while unemployed would receive EUR 150 less per month in adjusted daily allowances.