Lay-offs come in different forms, which affect whether the earnings-related daily allowance is paid in full or adjusted according to earned income. This, in turn, affects the final amount of daily allowance paid to you.

Types of lay-off:

- Full-time > full earnings-related unemployment allowance for the days of lay-off

- Reduced weekly working time > full earnings-related unemployment allowance for the days of lay-off

- Reduced daily working time > adjusted daily allowance (the income earned for the shorter working days is taken into account when assessing the amount of daily allowance)

- Combination of all the above

During a lay-off period, if the applicant has some days of full-time lay-off and some days of reduced working time, an adjusted daily allowance may be paid. The amount of the daily allowance is assessed according to the pay for the shorter working days and the full working days.

The fund always needs a statement from the TE Office to pay an earnings-related daily allowance for the lay-off. You must register with the TE Office as an unemployed jobseeker no later than on the first day of the lay-off, as earnings-related daily allowances can only be paid when you are registered as a jobseeker.

Full earnings-related unemployment allowance

You can apply for a full earnings-related daily allowance if you are laid off full-time or your weekly working time is reduced by a number of full days of lay-off.

The amount of the earnings-related daily allowance is stated in the unemployment fund’s decision to grant the daily allowance. The daily allowance is calculated from the income you earned in at least the 26 calendar weeks preceding the lay-off. The weeks used to determine the daily allowance must fulfil the employment condition, meaning that work has been done or remuneration has been paid for at least 18 hours per calendar week.

The daily wage used to calculate the full daily allowance is obtained by dividing the remuneration paid for 26 weeks of work by the number of working days in the same period (5 days per week, equating to 130 days). The number of working days does not include days when no remuneration was paid due to an approved absence, such as unpaid sick leave.

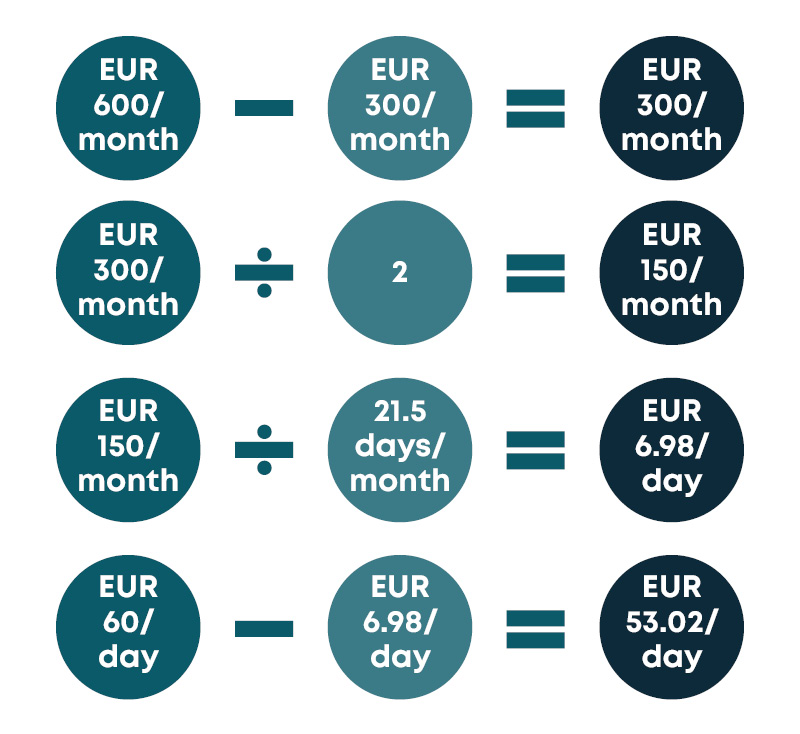

Figure 1: Calculating the daily wage used to determine the daily allowance

Adjusted unemployment allowance

Adjusted unemployment allowance is a daily allowance that takes into account the income earned on the days when the working time is reduced due to a lay-off or the earned income from shorter working days and shorter working weeks.

The daily allowance paid during a lay-off is also adjusted if you earn income from part-time or gig work for an employer other than the one who laid you off or from part-time business activity during the lay-off. The adjustment takes into account the income earned from your other work or part-time business activity.

If you are laid off from a part-time position, your earned income will be adjusted during the lay-off for as long as you receive income for part-time work during the lay-off period. This means that an adjusted daily allowance is also paid for a period of full-time lay-off for as long as you earn income for part-time work.

A further prerequisite for paying an adjusted daily allowance during a lay-off is that your working time exceeds 80% of a full-time employee’s working time. As regards reduced daily working time, the working time is examined for the entire adjustment period, which is either four full calendar weeks or one calendar month, depending on the payroll periods.

The adjusted daily allowance will be paid in the same amount for each eligible working day of the application period. The daily allowance will be paid for both lay-off days and days worked.

The amount of an adjusted daily allowance is affected by the amount of your earnings-related daily allowance and your earned income during the lay-off. Earned income subject to withholding tax shall not affect the amount of your daily allowance if it is less than the protected portion, i.e. 300 euros per month or 279 euros per four weeks.

Example

| Your full earnings-related allowance is 60 euros per day. You are laid off by reducing your daily working time. You receive a salary of 600 euros per month for the months of your lay-off. Since the salary is paid monthly, the application period is one calendar month. Half of the salary exceeding the protected part of the earnings affects the amount of earnings-related allowance (600 – 300) x 0.5 = 150. This 150 euros is divided by 21.5, which is the calculated number of working days in a month. Based on this calculation, the daily allowance is reduced by 6.98 euros a day. Therefore, the adjusted daily allowance is 60 – 6.98 = 53.02 euros a day, and it is paid for each working day of the adjustment period. |

Calculating the amount reducing the daily allowance:

Amount of adjusted daily allowance:

Your earned income during a lay-off period with a shorter working day affects your earnings-related daily allowance if the remuneration is actually paid to you. This is called a payment-based adjustment of the daily allowance. Earned income during a lay-off period with both shorter working days and shorter working weeks affects your earnings-related daily allowance if the remuneration is actually earned. This is called an earnings-based adjustment of the daily allowance.