With the Daily allowance calculator, you can estimate the amount of your earnings-related allowance.

Register as a job seeker at Job Market Finland.

How do different forms of lay-off affect the daily allowance?

We also pay an earnings-related daily allowance for the duration of a service promoting employment.

You can apply for earnings-related unemployment daily allowance if you are a member of the unemployment fund.

You can receive an earnings-related daily allowance when you have fulfilled the labour market policy conditions, the membership conditions of an unemployment fund, and the employment conditions.

Briefly:

- The fulfilment of the labour market policy requirements is examined by the employment authority in municipality or employment area (former Employment and Economic Development Office, TE Office), which issues a statement on the matter which is binding to the fund.

You must meet the membership condition.- During your membership, you must meet the employment condition.

Other general conditions for receiving the daily allowance include:

We will examine the fulfilment of the membership and employment conditions in connection with the processing of your application for an earnings-related daily allowance.

The employment authority examines your labour market policy requirements and issues a statement on this, which is binding to the unemployment fund. The fund cannot influence decisions made by the employment authority.

Proceed as follows:

- Register at Job Market Finland as an unemployed jobseeker

- You can register as a jobseeker in the E-services at Job Market Finland no later than on the first day of unemployment or lay-off. You can register even before the start of unemployment or lay-off.

- After registration, the employment official will contact you, agree on further measures and a possible personal meeting

Membership condition until 1.9.2024: The membership condition is met when you have been a member of the fund for at least 26 weeks. The membership period of another fund is also added to the 26 weeks if you have become a member within one month of the end of the previous fund membership.

Membership condition from 2.9.2024: The membership condition is met when you have been a member of the fund for at least 12 months. The membership period of another fund is also added to the 12 months if you have become a member within one month of the end of the previous fund membership.

Starting September, 2, 2024, the employment condition is accrued based on salary paid during a calendar month for work conducted (payment-based, i.e. euro-based employment condition).

The employment condition includes all such calendar months during which you have received a salary of at least 930 euros (excluding any holiday bonus and holiday compensation) for work performed since September 2, 2024.

The working month and the month which accrues the employment condition are not necessarily the same. For instance, if the work was conducted in October but salary for it was only received in November, the employment condition is accrued based on the salary paid in November. If no salary was paid in October, said month does not accrue the employment condition at all.

The received salary must be in accordance with the collective agreement. If your industry does not have a collective agreement in place, your salary for full-time work must be at least 1,430 euros per month in 2025.

After September 2, 2024, the employment condition is fulfilled once you have received employment condition-eligible earned income for a minimum of 12 calendar months. A calendar month refers to e.g. January, February or March.

In the future, pay subsidy work does not, in principle, accrue the employment condition at all.

An exception to this rule is pay subsidy work of the disadvantaged and disabled workers as well as the long-term unemployed aged over 60. Such work continues to accrue the employment condition even after September 2, 2024. When calculating the employment condition, 75% of the calendar months that count towards fulfilling the employment condition are taken into consideration from the 11th wage payment month onwards. The first 10 wage payment months do not yet accrue the employment condition. Fulfilling the 12-month employment condition therefore requires 26 employment condition months for which you have received pay. In other words, the requirement is 2 years and 2 months.

1) If an employer, during a calendar month, pays a salary for an earnings period exceeding one month, deviating from the standard salary period, the paid salary will be spread over the payment month and any preceding or following months, depending on the number of months that the income is paid for.

In most cases, a standard salary period is one month maximum.

2) If the salary is paid late due to a reason attributable to the employer or if the salary is paid via wage security, the salary is adjusted to the calendar month during which it should have been paid had it not been for the delay.

3) For any one-off performance bonuses etc. that are paid for a period exceeding one month, the performance-based part of the wage payment is spread over the entire earnings period.

The 28-month reference period for the employment condition remains as is, please see Reference period for employment condition.

Because the new euro-based rule requires a minimum of 12 calendar months and the employment condition can therefore not be fully fulfilled before September 2025, any employment condition weeks accrued by September 1, 2024 must be converted to corresponding employment condition months.

Any employment condition weeks accrued by September 1, 2024 (see Employment condition until September 1, 2024) are converted to corresponding employment condition months starting September 2, 2024. Consequently, 1–2 weeks fulfilling the employment condition correspond to one half of an employment condition month and 3–4 employment condition weeks correspond to one full employment condition month.

Employment condition weeks are converted into employment condition months by dividing the number of employment condition weeks by four

number of weeks ÷ 4 = employment condition months

Employment condition accrues based on working weeks until September 1, 2024 (working-time-based, i.e. earnings-based employment condition).

Until September 1, 2024, the employment condition accrues when:

The employment condition is fulfilled by September 1, 2024 when the number of accrued calendar weeks with the required minimum of 18 working hours reaches 26 over a 28-month reference period.

You do not have to work continuously or be employed full-time, as you can accrue weeks towards the employment condition in shorter periods, too.

If you have received daily allowance from a fund, the new employment condition is only accrued from the time that follows the fulfilment of the previous employment condition. Any given work period can only be included in on employment condition, not two.

The employment condition must be accrued during a 28-month reference period, counting backwards from the start of unemployment or layoff. The reference period may be extended for an acceptable reason for a maximum of seven years. Acceptable reasons include, among others, time periods for which you have received

The employment condition for a family member of a self-employed person is met when you have worked 12 qualifying months in a business owned by your family and of which you do not own anything after 1 September 2024.

Family members are defined as the spouse (including unmarried partners), children and parents living in the same household as the entrepreneur.

When the 12-month euro working condition is met in full for the period after 1 September 2024, you can combine work for another employer and work in a family business to count towards your working condition.

If even one calendar week before 2 September 2024 is counted towards your employment condition, 52 weeks meeting the employment condition are required. In that case, you cannot combine work done in the family business and work done for another employer to meet the employment condition.

Other benefits or restrictions may affect your entitlement to an earnings-related daily allowance so that they either prevent you from receiving the daily allowance or reduce the amount. In some cases they have no effect on the entitlement to a daily allowance or the amount.

The right to an earnings-related daily allowance is affected by, for example, social benefits that prevent the payment of a daily allowance, labour market restrictions and restrictions related to the employment. These may prevent the payment of a daily allowance in full.

Some social benefits may reduce the earnings-related daily allowance. These benefits are deducted from the daily allowance monthly, in which case the month is calculated to include 21.5 days. Deductive social benefits do not affect the overrun of the maximum period of the daily allowance, but each day with reduced payment reduces the maximum period by one day.

Below we have compiled the most common periods or benefits that prevent you from receiving a daily allowance. This list is not exhaustive.

Below is a breakdown of some of the most common benefits that reduce the earnings-related daily allowance. This list is not exhaustive.

The amount of an earnings-related daily allowance is not affected, for example, by the following social benefits. This list is not exhaustive.

You can calculate the estimate of the earning-related daily allowance you receive with the calculator.

Calculate an estimate of the amount of your daily allowance using the daily allowance calculator. The exact amount of the daily allowance is determined in the decision issued by the unemployment fund.

The earnings-related daily allowance is calculated from your wage income for at least 12 months prior to unemployment. The months used to determine the daily allowance must meet employment condition.

As a family member of an entrepreneur, you can only be granted an earnings-related daily allowance if you have worked in the family business for 52 weeks meeting the employment condition, and you have been a member of an employee's fund during that period. However, you cannot combine work in a family business with another employer in order to fulfil the employment condition.

The daily wage used to determine the daily allowance is obtained by dividing the salary paid for the month by 21.5. Days for which no salary has been paid due to an acceptable absence, such as unpaid sick leave, are not counted as working days.

If you have done seasonal work, your earnings-related daily allowance can be determined from the earnings of the 12 months prior to unemployment. This requires that the amount of work performed and, consequently, the earnings, have been significantly higher than usual.

From your monthly salary used to determine the daily allowance, the statutory percentage reduction corresponding to the earnings-related pension and unemployment insurance contribution and the sickness insurance daily allowance contribution, which is 3.54% in 2025, will be deducted first.

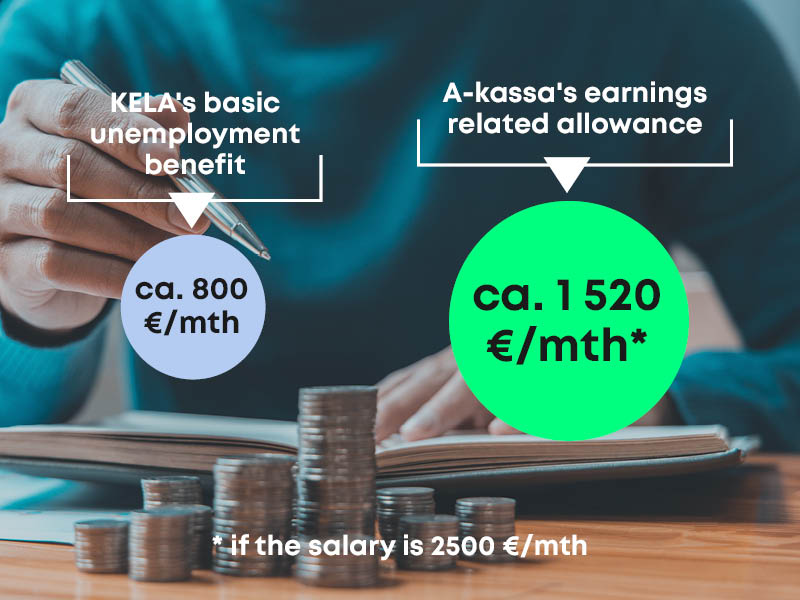

| Salary before unemployment / month | 2 500 € | 3 000 € |

| Earnings-related allowance (year 2025 / month) |

1 525 € | 1 742 € |

| Basic allowance (year 2025 / month) |

800 € | 800 € |

Staggering of earnings-related allowance enters into force on September 2, 2024. Both the first and the second staggering are calculated from the full earnings-related allowance.

| Full earnings-related allowance for first 40 days | 1st staggering, 41–170 days |

2nd staggering, 171 days -> |

| 100 % | 80 % | 75 % |

When calculating the amount of earnings-related unemployment allowance, not all components of the salary are considered. Below are some examples of these salary components.

Included (the list is not exhaustive)

Not included (the list is not exhaustive)

The daily allowance consists of a basic part, an earnings-related part and a possible child increase. In 2025

The child increments have been removed from unemployment benefits on April 1, 2024 (link to law changes)

A child supplement will be paid for a dependent child under the age of 18, which in 2024 will be

You can receive a child increase for your own children or for the children of a spouse living in the same household (up to three children).

Payment of supplementary amounts for the period of employment promotion services will cease on 1 January 2025. However, you can still receive the supplementary amount during 2025 until the end of the provision of the service or for a maximum of 200 days, if the service started no later than 31 December 2024. If the service is provided in separate periods that are not continuous, the increased earnings-related component is not paid for the periods that start on or after 1 January 2025.

If you participate in a service that promotes employment, the earnings-related daily allowance may be increased for a maximum of 200 days. If there are still days of daily allowance left to be paid after the employment-promoting service, they will be paid to you without an increased earnings component. A prerequisite for increased earnings is that you have agreed on the service in the employment plan with the TE Office or the municipality participating in the pilot on employment.

The amount of the increased earnings component is 55 per cent of the difference between the daily wage and the basic rate. If your monthly salary exceeds 3,534.95 per month, the increased earnings component is 25 per cent for the part exceeding this limit. Read more about studies and services promoting employment here.

Staggering of earnings-related allowance enters into force on September 2, 2024. Both the first and the second staggering are calculated from the full earnings-related allowance.

| Full earnings-related allowance for first 40 days | 1st staggering, 41–170 days |

2nd staggering, 171 days -> |

| 100 % | 80 % | 75 % |

The staggering applies to all recipients of earnings-related allowance, including those who are on an extension, working part-time or receiving entrepreneur’s daily allowance. However, the change does not impact allowance periods that have begun before September. Starting September 2, 2024, the new policy is applied to benefits that are paid out in accordance with the new 12-month employment condition. If the benefit payment is based on the employment condition of 26 calendar weeks that is in force until September 1, 2024, the staggering is not applied.

An example where staggering does not apply:

If you have fulfilled your employment condition and your daily allowance amount has been calculated in August 2024 or earlier, the staggering does not apply to you until you fulfill the employment condition again and the daily allowance is determined based on a 12-month employment condition.

An example where staggering applies:

If your allowance period starts in September or later and your employment condition has been fulfilled based on the new 12-month employment condition, the staggering applies to you.

In practice, the change starts to affect benefits in November. The first members under the staggering framework have then accrued 40 unemployment days, i.e. approximately two months. Those working part-time will see the impact of the staggering a little later, as their allowance period days are accrued slower.

The full, non-staggered earnings-related allowance can be received again when the recipient has again fulfilled the employment condition for wage earner or entrepreneur. In practice, this means that between periods of unemployment, wage income in accordance with the working condition has been accumulated for at least 12 calendar months.

You are eligible for an adjusted earnings-related allowance if you receive income and:

The adjusted daily allowance will be paid as the same amount for each eligible working day of the application period. The daily allowance will be paid for both unemployed days and the days worked.

The amount of adjusted daily allowance is affected by the amount of your earnings-related allowance and the income from part-time work and other work subject to the adjustment.

The income you receive during unemployment will affect your earnings-related allowance when the income is actually paid to you. This is called a payment-based adjustment of the daily allowance.

Remember to keep your job search active at Job Market Finland at all times while you apply for an adjusted earnings-related allowance. This means that the job search must also be active while you work.

You can calculate an indicative estimate of the amount of the adjusted daily allowance using the daily allowance calculator.

The amount of adjusted daily allowance is affected by the amount of your earnings-related allowance and the income from part-time work and other occasional work.

The protected part of the adjusted earnings-related daily allowance was removed on April 1, 2024 (link to law changes)

If earned income is paid for an earning period longer than one month and this differs from the usual salary payment period, the earned income is divided to affect the month of payment and the same number of subsequent months as the what earning of the income is based on. If the adjustment period is four calendar weeks, the income is divided into four-week adjustment periods according to their income-earning.

Example:

On 3 July, you have been paid €1,500 salary for part-time work you have done in April, May and June. Because the income has been earned during three months, it is divided in earnings-related allowance adjustment to affect the month of payment and the subsequent two months – July, August and Septembe; €1,500 / 3 months = 500 euros per month.

You cannot receive an adjusted daily allowance that is more than the amount of your full earnings-related allowance.

The total amount of earned income from your work and the adjusted daily allowance together can be no more than the amount of income that is the basis for the daily allowance.

If the total amount of the earned income and the adjusted daily allowance would exceed the income that is the basis for the daily allowance, the daily allowance is paid as an amount where the total income is equal to the salary that is the basis of the daily income.

You can calculate an indicative estimate of the amount of the adjusted daily allowance using the daily allowance calculator.

You can receive an adjusted daily allowance if your working hours do not exceed 80% of the working time in full-time employment:

The working time is taken into account for the period, when the income is paid to you.

Example: You start working at a part-time job in July. The salary is paid to you on 15 Aug 2023. The maximum working time for a full-time employee in the sector is 40 hours per week. 80 per cent of the maximum working time is 137.60 hours in a calender month. You have worked 140 hours in July, so the working time exceeds 80% of the maximum working time on the sector. You application for the period of 1–31 Aug 2023 is rejected due to the hours worked in July and paid in August. If you have not received any income from the salary in July, you will be paid the a full daily allowance for the July application.

If the earned income to be adjusted has been earned during an earning period longer than one month and it is adjusted to affect several months, the working time is also divided to affect the month of payment and the same number of subsequent months as the what earning of the income is based on. If the adjustment period is four calendar weeks, the working time considered in the adjustment is divided into four-week adjustment periods according to their income-earning.

Example:

On 3 July, you have been paid salary for a total of 100h of part-time work you have done in April, May and June. Because the income has been earned during three months, the working time, i.e., the number of paid working hours, is divided in earnings-related allowance adjustment to affect the month of payment and the subsequent two months – July, August and September. 100h= 3x33.3 hours per month.

If the working time taken into account in adjustment exceeds 80% of the full working hours of the sector, adjusted daily allowance cannot be paid.

If your weekly working time is reduced due to a temporary lay-off, you will receive a full daily allowance for the unemployed days. If your weekly working times is reduced due to a temporary lay-off and you receive income from part-time work, full-time work of up to two weeks, or business activities, you will be paid an adjusted daily allowance.

The amount of the full daily allowance and the adjusted daily allowance affects how the maximum period of time is accrued, when the adjusted daily allowance is paid.

The adjusted daily allowance accrues more slowly the maximum time of earning-related daily allowance of 300–500 days than the days of full daily allowance.

When you receive an adjusted daily allowance, the calculator accumulates days according to the amount paid. When the adjusted daily allowance has been paid corresponding to the full amount of the full daily allowance, one day is accumulated on the calculator.

Example: If your full daily allowance is 40 euros per day and your adjusted daily allowance is 33.70 euros per day, the maximum time calculator will accrue days from a four-calendar-week application (20 days x 33.70 euros): 40.00 = 16.85, that is, 17 days. When calculating the maximum payment period, the amount paid as an adjusted daily allowance is converted into full earnings-related allowance days.

You can receive daily allowance from the unemployment fund for five days a week for 300–500 days of unemployment. The maximum period depends on your work history and age:

| Work history | Maximum time |

| Up to 3 years | 300 days (approx. 14 months) |

| More than 3 years | 400 days (approx. 18 months) |

| At least 5 years of work history in the last 20 years and your employment condition is met after the age of 58 | 500 days (approx. 23 months) |

If you comply again with the employment condition of 12 calendar months, the maximum period starts again from the beginning. The earnings-related daily allowance is recalculated when the employment condition is met.

If your employment condition is met again during independent studies or labour market training, the daily allowance will not be recalculated in the middle of the service.

Once the maximum payment period has been reached, you can apply for labour market support from Kela. You will receive a written decision on the termination of your entitlement to an earnings-related daily allowance with your last payment notification. Submit the decision to Kela and the employment authority.

An earnings-related daily allowance can also be paid after the maximum period if you are entitled to additional days of an earnings-related daily allowance, i.e. you remain in the so-called "retirement streak".

Additional days of a daily allowance ("retirement streak") means that you can receive an earnings-related daily allowance even if the maximum period for the daily allowance has expired. Additional days can be paid until the end of the calendar month in which you turn 65.

You may be entitled to an earnings-related daily allowance for additional days if you have been employed for at least five years during the past 20 years and

| were born in the year, and | before the maximum period has been reached |

| 1957-1960 | 61 years |

| 1961-62 | 62 years |

| 1963 | 63 years |

| 1964 | 64 years |

You do not need to apply for additional days separately, but we will automatically examine your entitlement, based on your application for an earnings-related daily allowance.

If you have been paid additional days and you then intend to apply for an old-age pension

You can request a certificate at the earliest when you have been paid a daily allowance for at least one day during the month preceding the start of your pension.

For example, requesting a certificate for additional days

The A-fund has paid you additional days of an earnings-related daily allowance. You plan to retire on 1 April. You can request a certificate at the earliest when the daily allowance has been paid to you on or after 1 March.

If they wish, people born between 1950 and 1957 can retire on an old-age pension after the age of 62, and no early retirement deduction will be made from the pension.

Your daily allowance will be determined, i.e., recalculated, when

If your employment condition is met during independent studies or labour market training, the daily allowance will not be recalculated in the middle of the service.

The amount of your daily allowance is at least 80% of your previous daily allowance (without the child increase) when

There is no protection of 80% of the daily allowance if

The waiting period is seven days during which you have been unemployed as a jobseeker at Job Market Finland.

Weekdays from Monday to Friday are accepted as a waiting period, and a calendar week can include a maximum of five days of a waiting period, unemployment and working days. The waiting period must be accrued over a period of eight consecutive calendar weeks.

The waiting period cannot include time for which there is no entitlement to a daily allowance (for example, during the accrual of a financial benefit).

If you have working hours from part-time or occasional employment during the waiting period, this period is the number of hours equivalent to seven days.

Example

You work part-time for four hours a day and seven days per week from Monday to Friday. The maximum working time for a full-time employee in your work is 40 hours per week, or 8 hours per day.

You apply for an adjusted daily allowance for the duration of your part-time employment, and you have no other employment. As you work part-time for four hours a day, your waiting period also accrues at the rate of four hours per day. In this case, your waiting period will be reached in 14 working days.

For the duration of services promoting employment, no waiting period is applicable in practise. The waiting period runs at the same time as a daily allowance is paid for the duration of the service.

A midweek holiday can also be included in the waiting period in certain situations if you have registered as an unemployed job seeker with the employment authority before the midweek holiday. If the employer is obliged to pay a midweek holiday compensation or does not reduce your amount of salary for the midweek holiday due to layoff, that day cannot be included in the waiting period. If you are completely unemployed, the midweek holiday accrues the waiting period like other weekdays.

A waiting period is set when

The employment official issues a statement on the suspension period that is binding to the unemployment fund, and there is no entitlement to a daily allowance during the suspension period.

If you have resigned from your job without a valid reason or caused the employment to end, the employment official will set an unpaid time period, i.e., a suspension period.

The employment official issues a statement on the suspension period that is binding to the unemployment fund, and there is no entitlement to a daily allowance during the suspension period.

An exception to this rule is employment-promoting services agreed with the employment official , for which the daily allowance is paid concurrently with the suspension period.

A suspension period is different from a seven-day waiting period.

You can receive an earnings-related daily allowance if certain conditions are met during the waiting period of the sickness allowance. Apply for sickness allowance from Kela if your illness lasts more than 10 days (including Saturdays).

You cannot receive an earnings-related daily allowance if you receive sickness or partial sickness allowance from Kela or if your employer pays you sick pay.

Read more about sickness allowance on Kela's website.

If your illness lasted no more than 1+9 days (the first day of illness and 9 days of illness including Saturdays), you do not need to apply for sickness allowance from Kela.

If you are applying for an earnings-related daily allowance from the A-fund, proceed as follows:

If your incapacity for work continues even though the maximum period of 300 days for Kela's sickness allowance has been reached, you can apply for an earnings-related daily allowance from the fund.

If you are applying for an earnings-related daily allowance from the A-fund, proceed as follows:

You are not entitled to an earnings-related daily allowance paid by the unemployment fund for strike days if

Instead, in these situations, you can apply for strike pay from your own trade union or from another trade union that has called the strike.

If you are laid off, you are entitled to an earnings-related daily allowance for the days your are laid off, provided that

If you are applying for an earnings-related daily allowance for days, you are laid off and taking the above into account, follow these steps:

If your working week is shortened because you are laid off, you cannot receive an earnings-related daily allowance for strike days that fall on your working days.

You cannot receive an earnings-related daily allowance during a strike if you work part-time and have received an adjusted daily allowance from us.

If your work is interrupted due to industrial action in another industry, you may be entitled to earnings-related unemployment allowance.

When your work is prevented due to a strike in another industry that is not aimed at affecting your terms of employment, your employer has an obligation to pay seven days of wages. If the strike that prevents your work lasts longer than seven days, you are entitled to earnings-related unemployment allowance without the seven-day waiting period.

Also in this case, remember to register as a jobseeker at Job Market Finland so that you can apply for the daily allowance. Tell the employment authority that you have been prevented from working due to an industrial action (strike or lockout) by another group of employees or the employer.

You may be entitled to an earnings-related daily allowance if your work is interrupted due to industrial action in another industry.

NB! In this case, your employer has a seven-day obligation to pay wages. After seven days and if the strike that prevents you from working continues, you are entitled to an earnings-related daily allowance without a seven-day waiting period.

During the lay-off period, the payment of an earnings-related daily allowance depends on the provisions of the collective agreement.

The employer's obligation to pay wages for midweek holidays also depends on the collective agreement. You can check the provisions of the collective agreement on midweek holiday compensation, for example, with your trade union.

There can be a maximum of five compensation days in a calendar week. Therefore, earnings-related daily allowance can be paid for a maximum of five days per week. For example, if you are laid off from Monday to Friday (5 days) but receive a midweek holiday compensation for a holiday that falls on Saturday, the fund can only pay you the unemployment allowance for four days.

In the event of a weather barrier, you can apply for a daily allowance from the fund under certain conditions.

If work is prevented due to freezing temperatures, those working in the building and forestry industry must have agreed on a frost limit before starting work on the site. A weather barrier is a situation in accordance with a collective agreement in the building or the forestry industry where

In this case, you can apply for the daily allowance from the fund, if the employer has not paid wages or other remuneration for the days in question. However, always fill in the application for entire calendar weeks from Monday to Sunday.

In the forest machinery sector or in the sheet metal and industrial insulation sector an employee may be laid off due to a weather barrier. You can also apply for a daily allowance for these days if you are laid off.

If you are applying for daily allowance for the first time in the event of a weather barrier or your employment condition has been met again, the seven-day waiting period will be set normally.

In case of doubt, you should contact either your own trade union or the customer service of the A-fund.

Note! The Unemployment Fund specifically needs a revised tax card for the benefit if you want to change the tax rate.

Your tax rate will be increased to at least 25% when the earnings-related allowance is paid unless you deliver a revised tax card for the benefit to the unemployment fund. If the withholding tax for salary has been, for example, 15.50 percent, without a revised tax card it will automatically be increased to 25 percent. Please note that the tax percentage of the earnings-related allowance cannot be changed if you have ordered a revised tax card for your salary from the tax administration.

As a general rule, the Unemployment Fund receives tax withholding information directly from the Tax Administration. It is not necessary to send paper versions of tax cards that are meant for salary or revised tax cards meant for benefits to the unemployment fund.

You can order a revised tax card for benefits in the Tax Administration’s MyTax service and select A-kassa as the benefit payer. The tax card will then be sent electronically directly to the fund within 1–2 business days. In addition, see the tax administration’s instructions “How to request a tax card for wage or benefit income in MyTax”.

Your tax rate is also determined for other benefits, i.e., job alternation compensation, mobility allowance and restructuring protection allowance, in the same way as the earnings-related allowance.

If you have worked part-time while getting your pension, your earnings-related allowance is determined from the income from part-time work, in which case the amount of the full earnings-related daily allowance is lower than the daily allowance determined from the income from full-time work.

As a rule, a partial early old-age pension does not affect earnings-related unemployment allowance. In other words, the pension is not a benefit that prevents you from receiving earnings-related unemployment allowance and is not deducted from the allowance. However, a partial early old-age pension may have an impact on the amount of full earnings-related unemployment allowance calculated by the fund and on the payment status of the allowance.

You can apply for partial early old-age pension from your employee pension institution. You can retire on a partial early old-age pension at the earliest when you turn 61 if you were born in 1963 or earlier. If you were born in 1964, you can retire on a partial old-age pension at the age of 62.

The amount of earnings-related unemployment allowance for the period while you receive partial early old-age pension is determined immediately before the start of unemployment or temporary lay-off.

If you have worked full-time while receiving your pension, the period which you receive the pension has no effect on the amount of the daily allowance.

If you have worked part-time while receiving your pension, your daily allowance is determined based on income from part-time work. In this case, the amount of the full daily allowance is less than the allowance determined based on income from full-time work.

If you have worked full-time, receive a partial early old-age pension and are unemployed or laid off, the payment of your daily allowance is not affected. In other words, you will receive a full daily allowance even if the partial early old-age pension continues while you are unemployed. The partial early old-age pension is not deducted from your daily allowance.

If you have worked part-time, receive a partial early old-age pension, and become unemployed or are laid off, you will be paid adjusted daily allowance, and the wages for part-time work paid during the four-week or one-month conciliation period will affect the amount of earnings-related allowance. The partial early old-age pension is not deducted from your daily allowance.

Example 1: Full-time work and partial early old-age pension

You have worked full-time while receiving a partial early old-age pension. Your full-time salary is 2,500 euros per month, of which the amount of full daily allowance is 70.94 euros. Your become unemployed and after the waiting period, receive the full daily allowance of 70.94 euros per day.

Example 2: Part-time work and partial early old-age pension

You have worked part-time while receiving a partial early old-age pension. Your part-time salary is 1,875 euros per month, of which the amount of full daily allowance is 58.32 euros. You become unemployed. You are still paid the part-time salary of 1,875 euros during your first adjustment period. After the waiting period, there is no adjusted daily allowance left to be paid. If the next application period no longer has a payday for the part-time work, you will receive the full daily allowance of 58.32 euros per day for the following period.

Please find out the amount of your pension from your own employee pension institution before applying for a partial old-age pension.

You can also find more information about the partial old-age pension on the website of the Finnish Centre for Pensions.

Holiday compensation affects the right to earnings-related unemployment allowance in such a way that annual holidays not taken by the end of the employment relationship will postpone the start of earnings-related unemployment allowance payments by as many days as the holiday compensation paid corresponds to the average salary for the number of working days. This is called the periodisation of holiday compensation.

The periodisation applies to full-time employment that has lasted more than two weeks and has ended. Holiday compensation paid for part-time employment are not periodised but are adjusted when the daily allowance is paid.

For example, if you are paid a holiday compensation equivalent to a month’s wages when your employment ends, it is possible to start accruing the waiting period and pay the unemployment benefit only when this paid period ends, in this case, after about a month.

Example of periodization:

- The person's full-time employment, which lasted more than two weeks, has ended on January 31, 2024. At the end of his employment, he has been paid 1,500 euros in holiday compensation for annual leave that he has not taken.

- His average monthly salary has been 3,000 euros and his daily salary 3,000 euros: 21.5 days = 139.53 euros/day.

- The holiday compensation is divided by the average daily wage of 1,500 euros: 139.53 euros/day = 10 days.

- 10 payable days, i.e., two weeks from the end of the employment relationship, are used for the periodisation of holiday compensation.

- Earnings-related daily allowance cannot be paid from 1 February to 14 February 2024. After the period, the waiting period is taken into account, which is seven days, i.e. starting on February 15, 2024 and lasting until February 25, 2024.

- The payment of the earnings-related daily allowance can therefore start on 26 February 2024.

You can read more about the amount of earnings-related daily allowance here.

The following sources of income are taken into account when calculating the amount of an adjusted earnings-related daily allowance: