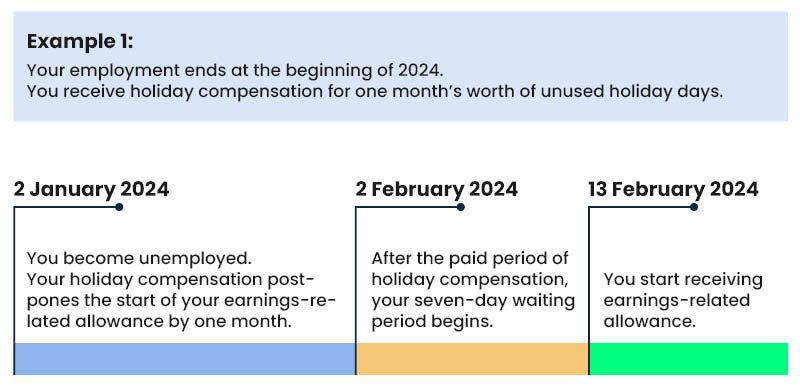

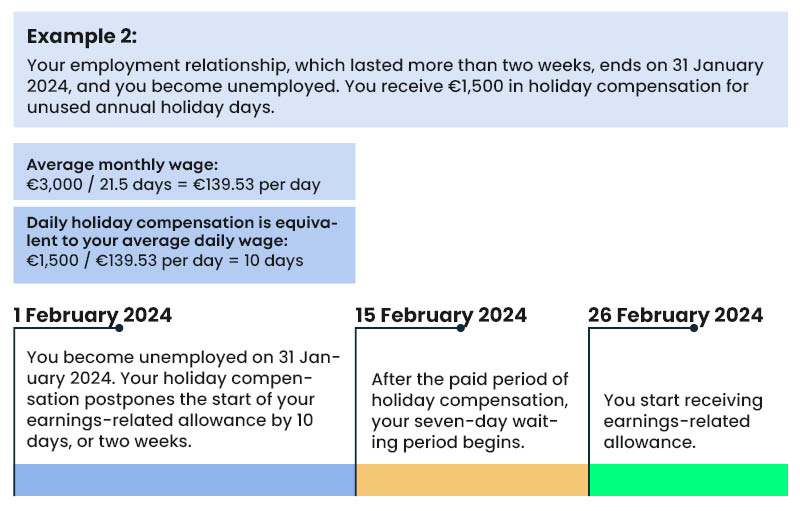

In relation to holiday compensation, periodisation means that, when your employment ends, the fund calculates how many days’ worth of holiday compensation you have accrued and deducts the resulting number of days from your earnings-related allowance. In practice, this means periodisation postpones the start of your earnings-related allowance.

If you have one month of unused holiday days at the end of your employment, the payment of earnings-related allowance will be postponed by approximately one month. With an average daily allowance, this will mean a gross cut of approximately €1,600.

Periodisation applies to full-time employment relationships that lasted at least two weeks and have ended. Holiday compensation paid for part-time employment is not subject to periodisation and is instead adjusted upon payment of your allowance.

When your employment relationship ends, any unused annual holiday days postpone the start of your earnings-related unemployment allowance by the number of holiday days the holiday compensation is equivalent to at your average daily salary. The period of holiday compensation only includes weekdays.

Periodisation of holiday compensation does not apply to temporary lay-offs, as these do not involve ending the employment relationship.

Your waiting period does not elapse during days on which holiday compensation is payable. The waiting period only begins after the paid period of holiday compensation. The waiting period is seven days.

The new legislation that came into force at the start of the year is applied to any annual holiday compensation based on an employment relationship ending on or after 1 January 2024.