Amendments entering into force on Aug 1, 2024

- Job alternation leave system will be abolished

Amendments entering into force on Sep 2, 2024

- Employment condition will be linked to euros earned

- Employment condition will be extended to 12 months

- Amount of earnings-related daily allowance will be staggered

- Pay subsidy work does not accrue entitlement to earnings-related allowance

- Age-related exemption rules for unemployment security to be abolished

Euro-based employment condition and extension of employment condition

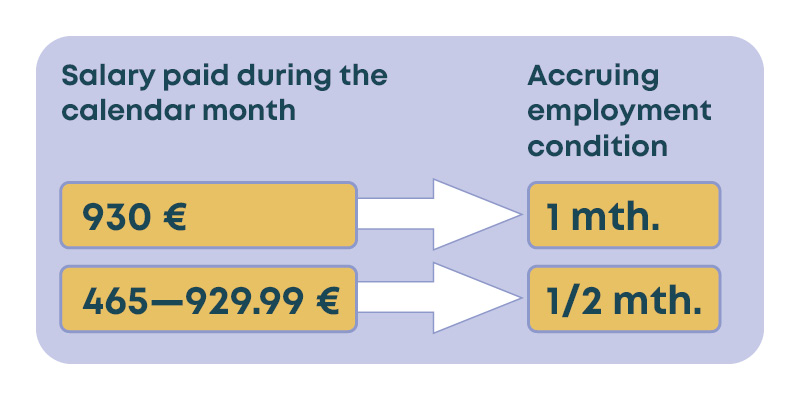

Euro-based employment condition means that entitlement to earnings-related allowance is based on specific earned income (gross), paid out during a calendar month. Only this kind of salary for insurance purposes accrues the employment condition. For instance, holiday compensation and holiday bonus are excluded.

Employment condition will accrue as follows:

You need a total of 12 paid calendar months of employment condition accrued during a 28-month reference period. If the accrued employment condition consists only of half months, you need a total of 24 paid calendar months.

The euro-based employment condition is applied starting on September 2, 2024. Calendar months that predate September 2, 2024 but are included in determining the employment condition are converted to employment condition months in accordance with the new stipulation. In practice, 1–2 employment condition weeks and the salary earned during that time is converted to one half of an employment condition month, while 3–4 employment condition weeks and the salary earned during that time is converted to one full employment condition month.

Employment condition is the required duration of employment while being a member of an unemployment fund before becoming entitled to earnings-related allowance for unemployment or layoff.

When the legislative amendment extending employment condition comes into effect, entitlement to earnings-related allowance requires salaried employment of 12 months while being a member of an unemployment fund. Employment condition months accrue in accordance with the euro-based employment condition.

With this legislative amendment, the fund’s membership condition likewise extends to 12 months.

staggering of earnings-related allowance

Staggering of earnings-related allowance enters into force on September 2, 2024. Both the first and the second staggering are calculated from the full earnings-related allowance.

| Full earnings-related allowance for first 40 days | 1st staggering, 41–170 days |

2nd staggering, 171 days |

| 100 % | 80 % | 75 % |

The staggering applies to all recipients of earnings-related allowance, including those who are on an extension, working part-time or receiving entrepreneur’s daily allowance. However, the change does not impact allowance periods that have begun before September. Starting September 2, 2024, the new policy is applied to benefits that are paid out in accordance with the new 12-month employment condition. If the benefit payment is based on the employment condition of 26 calendar weeks that is in force until September 1, 2024, the staggering is not applied.

In practice, the change starts to affect benefits in November. The first members under the staggering framework have then accrued 40 unemployment days, i.e. approximately two months. Those working part-time will see the impact of the staggering a little later, as their allowance period days are accrued slower.

Example:

| Monthly salary | Full earnings-related allowance for first 40 days | 1st staggering, 41–170 days | 2nd staggering, 171 days | Basic unemployment allowance by Kela |

| €2,500/month | €1,515/month | €1,212/month | €1,136/month | approx. €800 |

The earnings-related allowance is usually bigger than the basic unemployment allowance by Kela, even after the staggering.

We will later publish an earnings-related allowance calculator with staggering included.

September changes related to age and pay subsidy work

In principle, pay subsidy work no longer counts towards fulfilling the employment condition after September. There is an exception: pay subsidy work of disadvantaged and disabled workers or the long-term unemployed aged over 60. In these cases, pay subsidy work counts towards fulfilling the employment condition but only after the first 10 months have passed. The employment condition calculation takes into consideration 75% of the months that count towards fulfilling the employment condition.

The following age-related exemption rules are also abolished. Wage-earners’ employment condition is not accrued by such rehabilitation, training or work opportunities that the municipality is obliged to provide to an unemployed jobseeker who fulfils age-related provisions and whose right to a wage earner’s daily allowance is ending. Protective regulations concerning the amount of daily allowance, as related to these age-related exemption rules, are also no longer valid. What’s more, the protective regulation concerning those who are at least 58 years old will also be abolished. Previously, this regulation stipulated that the earnings-related allowance cannot be decreased for persons who fulfil the employment condition after turning 58.

Read more about Government Programme reforms to unemployment security