Unemployment security refers to financial support that you receive during unemployment or temporary lay-off. You can apply for unemployment security either from an unemployment fund, if you are a member of an unemployment fund, or from Kela. You are obliged to actively seek work during your unemployment.

When to apply for support from an unemployment fund and when to apply for support from Kela

If you are a member of an unemployment fund, apply for unemployment benefit from your unemployment fund. The fund will establish whether you meet the employment and membership conditions and are therefore entitled to earnings-related unemployment allowance. If you are not a member of an unemployment fund, apply for unemployment benefit from Kela.

Regardless of whether you are applying for benefit from an unemployment fund or Kela, you must first register as an unemployed job seeker with the TE Services. If you become unemployed or are temporarily laid off, register as an unemployed job seeker no later than on your first day of unemployment. After you have registered, the TE Services will provide the unemployment fund with a statement on your eligibility for unemployment benefit. Only after receiving the statement can the fund process your application.

How to apply for unemployment benefit

Unemployment benefit is always applied for retroactively, either from your own unemployment fund or from Kela. Therefore, registering with the TE Services as an unemployed job seeker will not suffice. You can fill out your first application two calendar weeks after you become unemployed or temporarily laid off. Attach to the first application a copy of your notice of termination and, if necessary, a copy of your employment contract if your employment has terminated, or of the notice of lay-off if you have been laid off. Follow-up applications are sent either in periods of four calendar weeks or monthly for the preceding period.

You must apply for unemployment benefit within three months of the start of the lay-off or unemployment or from the first day for which you are applying when applying with a follow-up application.

What are the different types of unemployment benefits?

Earnings-related unemployment allowance

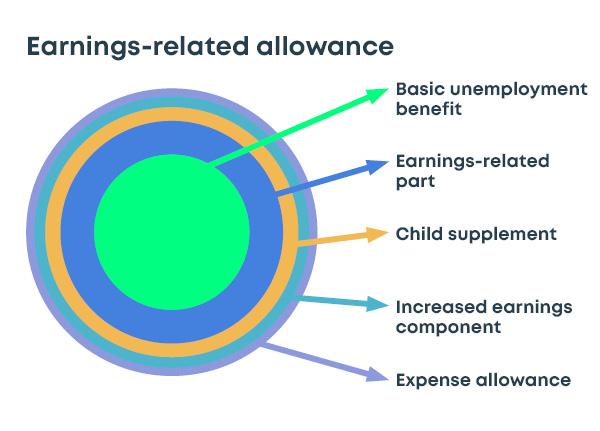

You can receive earnings-related unemployment allowance paid by the fund when you have met the employment condition during your membership in the fund. Since the earnings-related unemployment allowance paid by the unemployment fund consists of the basic unemployment allowance and an earnings-related component, it is almost always higher than the basic unemployment allowance paid by Kela. It is possible to receive a child increment to the earnings-related unemployment allowance if you have children under the age of 18. In addition to the daily allowance, a reimbursement of expenses or an increase in earnings-related unemployment allowance may be paid if you participate in a service promoting employment. All unemployment benefits are taxable income. Once the maximum duration of earnings-related unemployment allowance has been reached, you can apply for labour market subsidy from Kela. Earnings-related unemployment allowance is paid for a maximum of 400 days when the work history exceeds three years and 300 days when the work history is less than three years. If you are aged 58 or over and have worked for at least 5 years during the last 20 years, you can receive earnings-related unemployment allowance for a maximum of 500 days.

Basic unemployment allowance

Kela pays basic unemployment allowance to applicants who have met the employment condition whose employment condition has not been fully met during the period of membership in the fund, and to persons who are not members of any fund. Basic unemployment allowance is paid for a maximum of 400 days when the work history exceeds three years and 300 days when the work history is less than three years. In addition, and under certain conditions, persons who have fulfilled the employment condition after turning 58 can receive basic unemployment allowance for 500 days. In addition to the basic unemployment allowance, you can receive a reimbursement of expenses or an increased earnings-related unemployment allowance if you participate in a service promoting employment, and you will be eligible for a child increment if you have children under the age of 18. Once the maximum duration of earnings-related unemployment allowance has elapsed, you can apply for labour market subsidy from Kela.

Labour market subsidy

Labour market subsidy is paid to persons who have not fulfilled the employment condition at all or whose maximum duration of earnings-related or basic unemployment allowance has elapsed. Although there is no maximum time limit for the labour market subsidy, it is a means-tested benefit. The full labour market subsidy is equal to the basic unemployment allowance. The difference is that the income of other people living in the same household may reduce the labour market subsidy, while it does not reduce the amount of basic unemployment allowance.

What is the waiting period?

There is a waiting period for the payment of earnings-related unemployment allowance, basic unemployment allowance and labour market subsidy during which the benefit is not, as a rule, paid. The waiting period is five unemployed days during which you have been an unemployed job seeker at the TE Office. Days from Monday to Friday are accepted. The waiting period must accrue over eight consecutive calendar weeks.

What are the conditions for receiving unemployment benefits?

In order to receive unemployment benefits, certain conditions must be met.

You are entitled to earnings-related unemployment allowance if you have fulfilled the employment condition during your membership in the fund. You are entitled to Kela’s basic unemployment allowance if the employment condition has been met but you have not been a member of the fund at the same time.

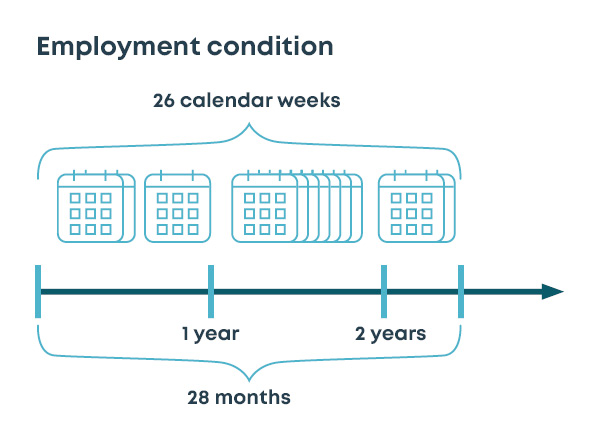

The general rule is that, in both cases, the employment condition is fulfilled when you have been in paid employment for at least 26 calendar weeks (approximately 6 months) during the 28 months immediately preceding unemployment, i.e. during the review period. The review period may be extended by a maximum of 7 years if you have been excluded from the labour market due to illness, rehabilitation, military service, non-military service, full-time studies or caring for a child up to 3 years old. At the weekly level, the employment condition is met when the member is in paid employment for at least 18 hours during a calendar week. More detailed information on the employment conditions for employees, family members of entrepreneurs and full-time entrepreneurs is available from the links below.

If you do not meet the employment condition at all, you can apply for labour market subsidy from Kela.

Both the unemployment fund and Kela receive the salary information required for processing applications from the Incomes Register. If necessary, you will be asked for additional information.

Additional information about A-kassa’s employment condition

Additional information about Kela’s employment condition

Additional information about the Entrepreneur Fund’s employment condition

A person applying for earnings-related unemployment allowance from an unemployment fund must meet the membership condition in addition to the employment condition. The membership condition is met when you have been a member of the fund for at least 26 weeks. The period of membership in another fund is also counted towards the 26 weeks if you have joined within one month of the end of your previous fund membership.

What can prevent you from receiving earnings-related unemployment allowance?

Other benefits you receive or certain restrictions may affect your entitlement to earnings-related unemployment allowance in such a way that they either prevent you from receiving daily allowance altogether or reduce the amount of the daily allowance. The right to earnings-related unemployment allowance is affected by, for example, social insurance benefits that prevent the payment of daily allowance, such as parental allowance, sickness allowance or rehabilitation allowance, as well as labour market restrictions and restrictions related to the employment relationship. These may prevent the payment of daily allowance altogether. There are also benefits that have no effect on daily allowance. These include, for example, child benefit, housing allowance and social assistance under the Social Welfare Act.

If you have resigned from your job without a valid reason or caused the termination of the employment relationship yourself, the TE Office will impose an unpaid suspension period (karenssi). In other words, you will not be entitled to daily allowance during the unpaid suspension period. The exception to this are employment-promoting services agreed with the TE Office, during which daily allowance can be paid during the unpaid suspension period.

What is the unemployment security situation for a laid-off person?

If you are laid off, you can receive unemployment security from the unemployment fund or Kela for the duration of the lay-off. A lay-off means that work and salary payments are temporarily suspended, but the employment relationship remains in effect. Lay-offs can be temporary or for an indefinite period. The application process is similar to applying for unemployment benefit if you are unemployed.

Can I receive unemployment benefit if I work during unemployment?

If you work part-time or occasionally during your unemployment, you can apply for adjusted daily allowance. Part-time work is defined as work in which the working hours agreed in the employment contract do not exceed 80% of the maximum working hours of a full-time employee in the industry. Casual work, on the other hand, refers to work performed in a full-time employment relationship which lasts no more than two weeks (14 days). In addition, adjusted daily allowance is paid to persons who earn income from part-time business activities or who have been laid off with reduced working hours. The application process for adjusted daily allowance is similar to a normal application for daily allowance.