Register as an unemployed jobseeker at Job Market Finland

In a lay-off, based on the contract, the employer suspends work and salary payment for production and financial reasons temporarily. Suspension of work and salary payment can be either partial or full-time. At the employee's request, the employer must provide a written certificate of the lay-off, which at least states the reason for the lay-off, the start time, and its duration or estimated duration.

You can apply for an earnings-related daily allowance from the A-fund if you are our member and have been laid off.

If you have been laid off:

1. Register as an unemployed jobseeker in the E-services at Job Market Finland

2. Fill in the daily allowance application in the A-fund's eServices

3. Add attachments to the application

4. Submit your application at the end of the application period

5. Provide missing information

6. Notify us of any changes

The processing status of your application is displayed on the eService homepage and the Status Information tab. The up-to-date processing status of your application is available here.

Attach the necessary information to your application for processing. If there are any changes in your circumstances affecting your entitlement to daily allowance, please notify us promptly. You do not have to submit original attachments. Copies are acceptable. We will also accept, for example, a picture taken with a mobile phone of an attachment, if it is legible.

Send the attachments to us as soon as you receive them. Attachments sent through eServices will be received immediately. Our processor will contact you if we need more information to process your application.

Lay-off notice

At the beginning of the lay-off, submit the lay-off notice attached to the application.

Tax card

We receive your tax card information directly from the tax authority. We recommend that you apply for a revised tax card for the benefit, in which case tax will be withheld according to the information in the tax card. If you use your tax card for wage income when applying for a benefit, the withholding tax is always at least 25 per cent. You can order a revised tax card for the benefit from the tax administration's MyTax service. In the MyTax service, you can send the revised tax card electronically directly to us by selecting the Open Unemployment Fund as the payer of the benefit.

Personal tax decision

If you have a business, please provide us with a personal tax decision on the most recently confirmed taxation. Also submit the breakdown part of the tax decision if you are a shareholder in a limited liability company or cooperative, or a partner in a general or limited partnership. If you are a shareholder in an estate, in addition to the personal tax decision, also submit the tax decision for the estate.

Social benefits

If you receive a social benefit that affects the amount of your daily allowance (for example home care allowance, partial disability pension or partial care allowance), submit the decision on granting the benefit to us. Be sure to also report any changes in the amount of the benefit. If the social security benefit has been granted by Kela, a simple notification of the benefit, for example, in the additional information in the daily allowance application, is sufficient.

Salary information

You do not need to send a payslip, as we receive salary payment data directly from the Incomes Register. However, if the Incomes Register data is incomplete, we may ask you, for example, for a payslip or a salary statement.

Example If you are applying for a daily allowance for four calendar weeks from 5 April to 2 May 2021, you can send the application to the cashier no earlier than Sunday 2 May 2021.

Our processor will contact you if we need more information to process your application. Please submit any missing attachments or additional clarifications we have requested through our eServices.

Remember to notify us of any changes affecting your entitlement to daily allowance and any changes in your personal and contact information.

Notify us promptly of any changes affecting your entitlement to daily allowance and the payment of daily allowance in your situation. You should also keep your information up-to-date for the processing of your application. You can report changes through eServices, or by post. You can also provide some of the information by calling our service number.

If you or your spouse are paid child home care allowance, please indicate this in the application. If your spouse receives child home care allowance, include more detailed information on your spouse's possible employment and studies and on the person caring for the child. You should also notify us of any changes in child home care allowance or the discontinuation of the allowance. Decisions on child home care allowance do not need to be sent to us.

Send the decision on granting the pension to us either through the eServices, or by post. You do not need to send a new decision annually on the size of the pension resulting from indexation. The data is submitted to us directly from the Incomes Register. If you receive a partial early old-age pension, the decision on granting the pension does not need to be sent to us. A partial early old-age pension does not affect the payment of an earnings-related daily allowance

If your lay-off ends due to termination of employment, please provide us with a copy of the notice of termination. We will obtain your wage data from the Incomes Register. However, if the data in the Incomes Register is incomplete, we may ask you for your wage data until the end of your employment. You should also notify the TE Office of the termination of employment.

If your lay-off ends due to termination of employment, please provide us with a copy of the notice of termination. We will obtain your wage data from the Incomes Register. However, if the data in the Incomes Register is incomplete, we may ask you for your wage data until the end of your employment. You should also notify the TE Office of the termination of employment.

If you retire on an old-age pension or have been granted another benefit that prevents you from receiving the daily allowance, please notify us at the latest in connection with your last application for a daily allowance.

If you fall ill and your illness lasts more than ten days, you can claim sickness allowance from Kela. Report your illness via an application. Also indicate on the application whether you have claimed sickness allowance from Kela. The waiting period for qualifying for sickness allowance is the first day of illness plus the following nine days (including Saturdays). In the event of an accident or the same illness within 30 days, the waiting period is one day. We can pay an earnings-related daily allowance for the waiting period of the sickness allowance if you have received unemployment benefit just before the illness. Read more about falling ill when unemployed here.

Account number

You can provide a new account number in eServices, include it in your application or submit it in writing by post. You cannot provide a new account number over the phone.

Information on children

Please inform us of the dates of birth of your dependent children under the age of 18 for which you are applying for a child increase. You can receive a child increase retroactively for a maximum of three months. For a child under the age of 18 living in the same household (of your cohabiting partner or spouse), you are entitled to a child increase from the date on which you move. If you separate, please notify us without delay. You are entitled to a child increase for your own dependent child until the child reaches the age of 18.

Contact details

You can notify us of a change of address or a new phone numberin eServices by entering the information in the additional information section of the follow-up application or by calling the service number.

Notify us promptly of any changes affecting your entitlement to daily allowance and the payment of daily allowance in your situation. You should also keep your information up-to-date for the processing of your application. You can report changes through eServices, or by post. You can also provide some of the information by calling our service number.

If you or your spouse are paid child home care allowance, please indicate this in the application. If your spouse receives child home care allowance, include more detailed information on your spouse's possible employment and studies and on the person caring for the child. You should also notify us of any changes in the child home care allowance or the discontinuation of the allowance. Decisions on child home care allowance do not need to be sent to us.

Send the decision on granting the pension to us either through the eServices, or by post. You do not need to send a new decision annually on the size of the pension resulting from indexation. The data is submitted to us directly from the Incomes Register. If you receive a partial early old-age pension, the decision on granting the pension does not need to be sent to us. A partial early old-age pension does not affect the payment of an earnings-related daily allowance

If your lay-off ends due to termination of employment, please provide us with a copy of the notice of termination. We will obtain your wage data from the Incomes Register. However, if the data in the Incomes Register is incomplete, we may ask you for your wage data until the end of your employment. You should also notify the employment authority of the termination of employment.

If your lay-off ends due to termination of employment, please provide us with a copy of the notice of termination. We will obtain your wage data from the Incomes Register. However, if the data in the Incomes Register is incomplete, we may ask you for your wage data until the end of your employment. You should also notify the employment authority of the termination of employment.

If you retire on an old-age pension or have been granted another benefit that prevents you from receiving the daily allowance, please notify us at the latest in connection with your last application for a daily allowance.

If you fall ill and your illness lasts more than ten days, you can claim sickness allowance from Kela. Report your illness via an application. Also indicate on the application whether you have claimed sickness allowance from Kela. The waiting period for qualifying for sickness allowance is the first day of illness plus the following nine days (including Saturdays). In the event of an accident or the same illness within 30 days, the waiting period is one day. We can pay an earnings-related daily allowance for the waiting period of the sickness allowance if you have received unemployment benefit just before the illness. Read more about falling ill when unemployed here.

Account number

You can provide a new account number in eServices, include it in your application or submit it in writing by post. You cannot provide a new account number over the phone.

Information on children

Please inform us of the dates of birth of your dependent children under the age of 18 for which you are applying for a child increase. You can receive a child increase retroactively for a maximum of three months. For a child under the age of 18 living in the same household (of your cohabiting partner or spouse), you are entitled to a child increase from the date on which you move. If you separate, please notify us without delay. You are entitled to a child increase for your own dependent child until the child reaches the age of 18.

Contact details

You can notify us of a change of address or a new phone numberin eServices by entering the information in the additional information section of the follow-up application or by calling the service number.

Your membership fees must be up-to-date before we can pay the daily allowance. Read more about membership fees.

During the lay-off period, the payment of an earnings-related daily allowance depends on the provisions of the collective agreement.

The employer's obligation to pay wages for midweek holidays also depends on the collective agreement. You can check the provisions of the collective agreement on midweek holiday compensation, for example, with your trade union.

There can be a maximum of five compensation days in a calendar week. Therefore, earnings-related daily allowance can be paid for a maximum of five days per week. For example, if you are laid off from Monday to Friday (5 days) but receive a midweek holiday compensation for a holiday that falls on Saturday, the fund can only pay you the unemployment allowance for four days.

Reasons comparable to lay-offs

A reason comparable to a lay-off means that the employee's obligation to work and the employer's obligation to pay wages have been completely interrupted. Reasons may for example include:

It is also possible to apply a reason comparable to a lay-off to fixed-term employment.

Example: fire at the workplace: In the event of a fire, the employer's obligation to pay wages ends after 14 days. In this case, employees do not need to be separately laid off. In this case, remember to register as an unemployed jobseeker at Job Market Finland. You can contact the employment authority even before you are laid off. It is worth mentioning to the employment authority that the labour policy statement they have submitted to the unemployment fund mentions a reason comparable to lay-off due to a fire. After the seven-day waiting period, an earnings-related daily allowance will be paid to you normally, as in other lay-off situations.

There are several different forms of lay-offs, each with their specific impact on daily allowance payouts. Furthermore, the form of a lay-off has an impact on the final amount of daily allowance.

Lay-off options:

- full-time > earnings-related allowance is paid for lay-off days

- shortening of weekly working hours of a full-time job by full working days > earnings-related allowance is paid for lay-off days

- shortening of daily working hours > adjusted earnings-related allowance

- combination of all of the above

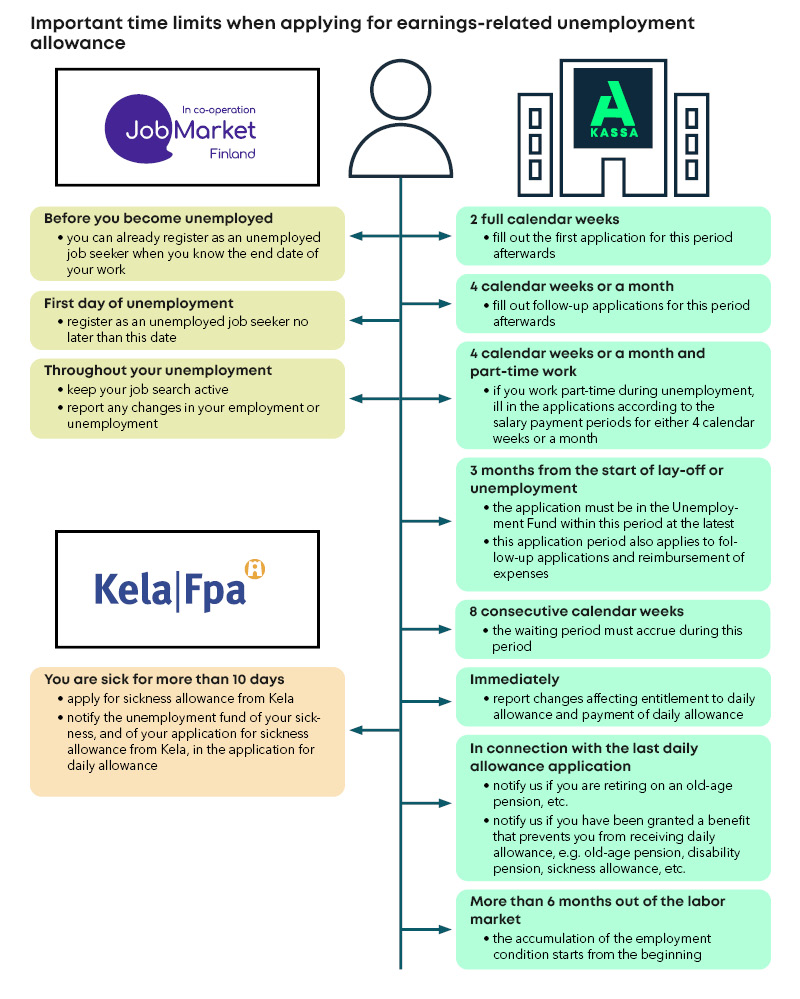

Paying out earnings-related allowance during a lay-off always requires the fund to have a statement from an employment authority. You should register as an unemployed jobseeker at Job Market Finland no later than your first lay-off day, as payouts of earnings-related allowance for the lay-off period can start no earlier than from the date of registration.

A lay-off is considered full time when you are laid off from a full-time job for a minimum of one full calendar week from Monday to Sunday. If your full-time lay-off period does not include any days for which salary is paid, all lay-off days can be specified as unemployment days in your application. You should detail actual information for weekends as well instead of using the ‘weekend’ entry in the online application.

If you have other work or you engage in entrepreneurial activities, this must be specified in the application. If you are laid off full-time but you have a payday from another part-time or full-time job (lasting a maximum of two weeks) during the calendar month or four-week period, this income must be taken into account. In this case, your daily allowance will be adjusted, meaning that the adjustment for income from other work is payment-based, i.e. determined at the time of payment.

Midweek holidays must always be entered in the application as ‘other reason: midweek holiday,’ if you receive a separate midweek holiday compensation for them or if your salary is not subject to midweek holiday salary reduction during your lay-off week.

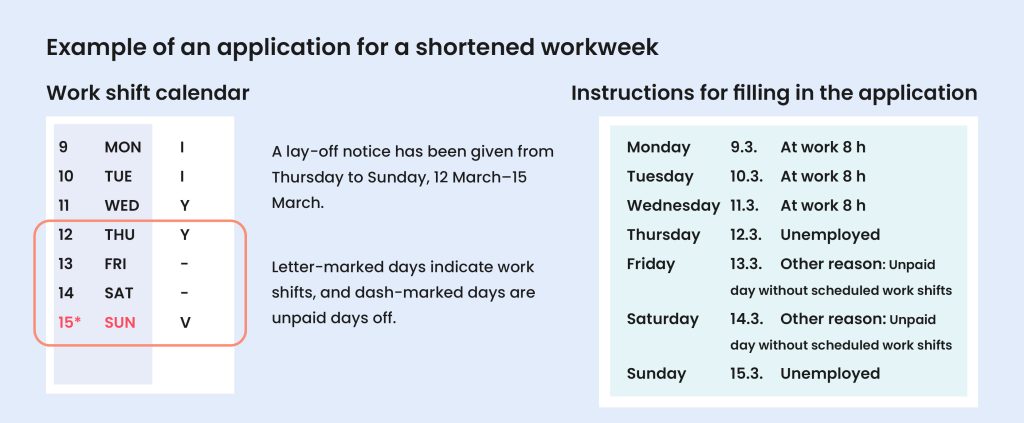

A lay-off that does not last a full calendar week from Monday to Sunday is considered a lay-off for a shortened workweek. For instance, a lay-off which lasts from Wednesday until Tuesday the following week constitutes a lay-off for a shortened workweek. When processing an application for a shortened workweek, the unemployment fund must review the actual loss of salary. This is because paying out an unemployment benefit requires that the employee receive reduced salary in accordance with their reduced working hours.

For a shortened workweek, you must always fill out an application covering a full calendar week (Monday to Sunday) because the unemployment fund has to ensure that your working hours for the lay-off week do not exceed 80% of your full-time working hours. You should also note that, as stated in the Unemployment Security Act, a calendar week may include a maximum of five working days, unemployment days or waiting period days. Those laid off from shift work may end up with a calendar week which includes a lay-off day and five working days. In such cases, the unemployment fund cannot pay daily allowance for the lay-off day because the calendar week in question already includes the maximum number of days subject to compensation, i.e. five working days.

In your application for a shortened workweek, only days with a reduced salary due to lay-off may be reported as unemployment days. You should detail actual information for weekends as well. If you have other work or you engage in entrepreneurial activities, this must be specified in the application. In case of a lay-off for a shortened workweek, you have to report the days you have actually worked in another job. This is because income earned on these working days is adjusted using the earnings-based model, i.e. for the time period the work took place.

If you have been laid off from shift work, such as work that observes the TAM37 working time system, potentially including work shifts for every day of the week, you should enter ‘unemployed’ in your application for the day you were scheduled to start the shift for which you have been laid off. For instance, if your lay-off starts on Monday with a night shift from 10 p.m. to 6 a.m., you should enter Monday as your unemployed day even though the lay-off hours extend to Tuesday.

If your lay-off notice was issued for a period shorter than a full calendar week for which both unpaid days without work shifts and paid working days were scheduled, only the days which had shorter working hours and for which no salary was paid due to the lay-off should be entered in the application as lay-off days. During a shortened workweek, it is not possible to apply for daily allowance for an unpaid day without scheduled work shifts, because working hours were not shortened and no salary was lost due to a lay-off. But if you had a paid day without scheduled work shifts in your shift calendar and you lose your salary for the day due to a lay-off, such a day should be entered in your application as an unemployed day. An incorrectly filled out application may be returned to you for revision.

If the lay-off takes the form of shortened daily working hours, you must report your actual working hours in your application. The application should be filled out for four full calendar weeks or for a month, whichever accurately reflects your salary periods. In the application, enter both workdays and working hours completed during those workdays. If you have been working shifts, the application must include both paid and unpaid days for which no shifts were scheduled, because any days listed as unpaid days in your shift calendar are not considered lay-off days. You should also report any midweek holidays if you have received midweek holiday compensation for them or if your salary was not subject to midweek holiday salary reduction due to your lay-off.

The salary income you receive for your shortened workday lay-off impacts your earnings-related allowance based on the time the salary is actually paid to you. This is called payment-based adjustment of daily allowance.

A mixed lay-off refers to a situation where the lay-off is a combination of all the various lay-off options. During a mixed lay-off, the laid off person works both full days and shorter days but is also laid off for full days. If the lay-off includes both shortened daily working hours and full lay-off days, the day when you had no working time at all is entered in the application as an unemployed day. For days with shortened daily working hours, adjusted earnings-related allowance is paid.

The way the lay-off starts affects the choice of adjustment. If the lay-off starts purely as a shortened workday, the adjustment is payment-based, i.e. adjusted at the time the salary income is paid. While an ongoing lay-off may eventually turn into a mixed lay-off, this does not affect the adjustment, which continues to be payment-based until the lay-off ends. If the lay-off starts purely as a shortened workweek and you have other work or engage in entrepreneurial activities during your lay-off period, the adjustment is earnings-based, i.e. determined by the period during which the salary is earned.

By definition, ‘adjusted daily allowance’ is an allowance which accounts for salary income earned during a workday that was shortened by lay-off, or for salary income earned during both a shortened workday and a shortened workweek.

Daily allowance for the lay-off period is also adjusted if, during the lay-off, you receive income from part-time or on-call work for another employer or from part-time entrepreneurial activities. The adjustment also takes income from other work or part-time entrepreneurial activities into account.

If you have been laid off from part-time work, this income continues to be adjusted during your lay-off for as long as you receive income from the part-time job during the lay-off. This means that you will receive adjusted daily allowance even for your full-time lay-off period for as long as you are paid a salary for your part-time work.

As an additional prerequisite for receiving adjusted daily allowance for your lay-off period, your working hours are not allowed to exceed 80% of the working hours of a full-time employee. For a shortened workday, your working hours are reviewed for the entire adjustment period, which is either four full calendar weeks or a calendar month, depending on salary periods. For a shortened workweek, working hours are reviewed per calendar week.

Adjusted daily allowance is paid in equal instalments for the duration of the application period for each weekday for which you are entitled to the benefit. Daily allowance is paid for both lay-off days and workdays.

The amount of your adjusted daily allowance is affected by the amount of your daily allowance and your salary income for the lay-off period.