Conducted in August 2025, Open Unemployment Fund A-kassa’s member survey is exceptionally loud and clear with its results: government cuts to unemployment security have significantly undermined the financial security of unemployed members. As an incentive for finding employment, they are widely considered a failure. With the legislative amendments, the government aimed to make finding employment easier and work itself financially more worthwhile. The amendments have gradually entered into force during 2024–2025.

Most respondents had recently been subject to unemployment security. A remarkable 86% of respondents stated that they have applied for unemployment benefits from the unemployment fund or Kela in the past 12 months. This means that most of the respondents have current first-hand experience of the unemployment security system. 864 members responded to the survey.

–Our members clearly consider the cuts unjust, especially as they target people who are already in a challenging position at the job market. While the cuts were supposed to encourage people to work full-time, it is not possible for many respondents due to e.g. their health or the fact that full-time jobs are simply not available, says Kaisa Tikka, A-kassa’s Director of Administration.

Income losses amount to up to hundreds of euros

According to the survey, 94% of the respondents think the legislative amendments have had an impact on their financial security. Most of the respondents, 65%, have lost more than 300 euros a month (36% have lost 400+ euros). Staggering of earnings-related allowance, a more stringent employment condition and removal of the protected part were thought to be particularly harmful.

You have to calculate everything in advance: what you can afford, what you can buy. At times I’ve been forced to skip buying medicine in order to be able to pay my bills. – A-kassa member

– Many respondents described the impact of the cuts as unreasonable or catastrophic. Another strongly highlighted point is the fact that it is no longer worth it to accept a part-time job. This emphasises how the government decisions have resulted in financial distress for many people, says Tikka.

With the removal of the protected part of adjusted earnings-related allowance, an unemployed person may no longer earn more than €300 a month without the earnings impacting their unemployment benefits. 65% of the respondents and 83% of part-time workers lamented that the change has a major financial impact on them.

According to the respondents, the staggering of earnings-related allowance (gradually decreasing the level of earnings-related allowance as unemployment continues) proved to be the single harshest financial change. A remarkable 77% of the respondents estimated that the staggering has a major impact on their financial standing.

Linking the employment condition to euros earned (instead of work weeks, unemployment security is provided based on a certain monthly salary income) caused a major financial impact on 45% of the respondents.

Extending the employment condition from 6 months to 12 had a major financial impact on 65% of the respondents. Many stated that the extended employment condition delays or prevents eligibility for earnings-related allowance.

Another significant change was the extension of the qualifying period from 5 days to 7, with 45% of the respondents estimating it having a major financial impact. In practice, this cut means that there are now two more non-benefit days at the start of each unemployment period, leading to reduced total benefits.

The removal of the child increment affects those who have dependent children. 30% of all respondents and 51% of those aged 35 to 40 estimated that it has a major financial impact.

I have a family of 7, and our daily allowance was reduced by more than 500 euros due to the removal of the child increment. The staggering further decreased our benefits as both parents were unemployed. It put us in a really difficult situation, and forced us to tighten the purse strings on groceries.– A-kassa member

It’s made our situation more difficult: I’ve had to take out a loan in order to pay my bills and buy groceries. The removal of the child increment has affected my family’s financial situation in a major way. I think that the legislative amendments are putting people in a tight spot and making their lives more difficult. – A-kassa member

The loss of child increments made a huge dent in our finances (3 children). The removal of the protected part rendered short-term employment relationships worthless. – A-kassa member

Incentives do not work – working part-time is not worthwhile

The government wanted to reform u

nemployment security to make working more worthwhile. However, the survey indicates that the opposite has happened. The majority of respondents believe that the cuts have not had a positive impact on finding employment, but have instead had the opposite effect.

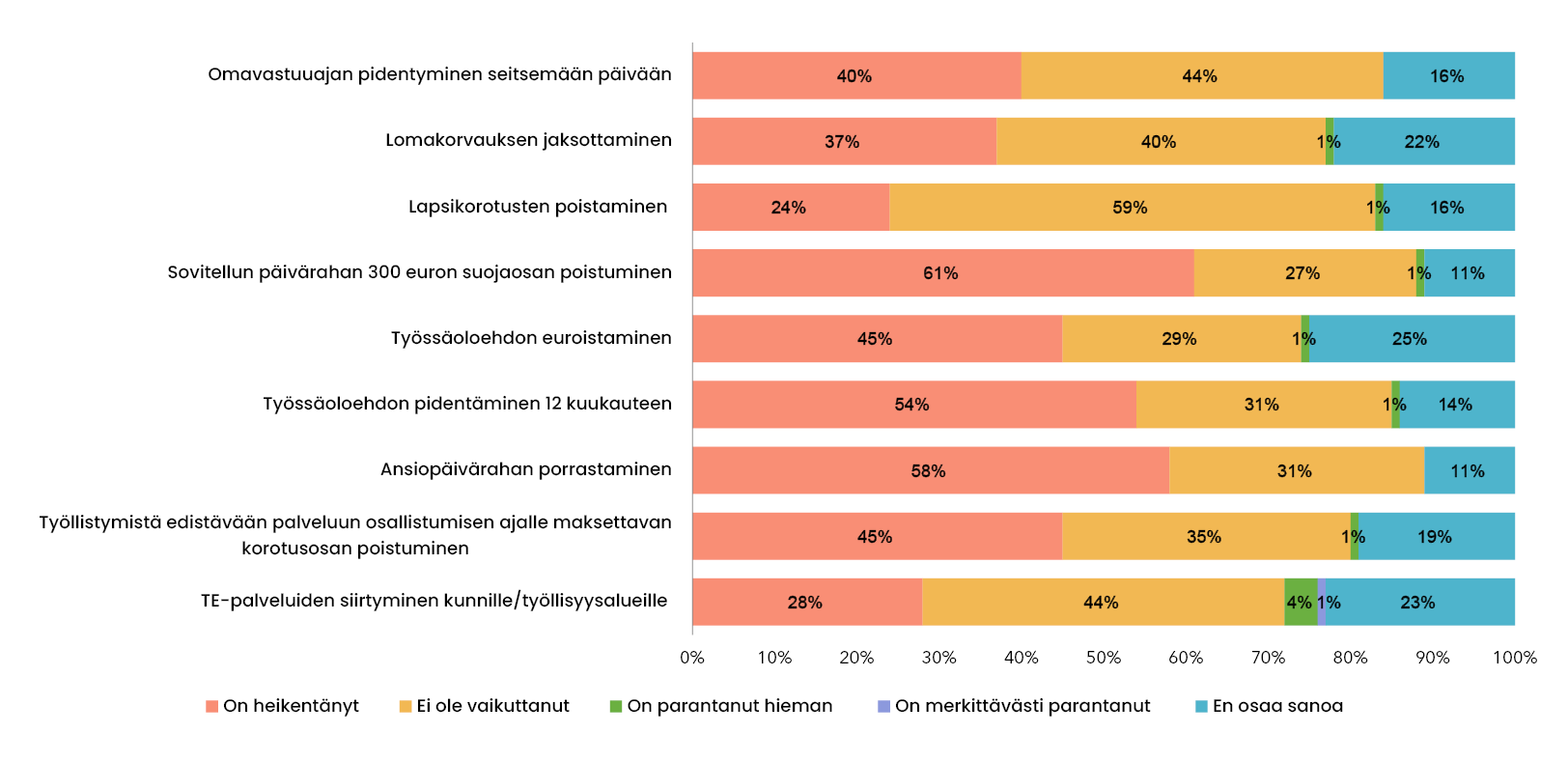

The most harmful amendment in terms of finding employment seems to be the removal of the protected part of adjusted earnings-related allowance. 61% of the respondents felt that it specifically had diminished their employment opportunities.

70% of the respondents said that due to the legislative amendments, they have not made the transition from part-time work to full-time employment. Up to 48% of the respondents are now more reluctant to accept part-time work because they feel that they will just be punished for it financially. Brief part-time and on-call work is no longer worthwhile as even short work periods reduce the benefits, and accepting employment comes with expenses (such as travel costs). Slightly under 15% of the respondents became more willing to accept full-time work only. However, based on the open-ended questions, such work is hard to find.

I work in an industry where working part-time and self-employment are normal. Full-time work is rarely available. It is not possible to just ‘transition’ to full-time employment, regardless of what kind of legislative amendments the government makes. The changes have done nothing except make my financial situation worse. – A-kassa member

At its worst, removing the protected part makes accepting part-time work not financially worthwhile. It also makes life more difficult, as the fund always has to take the time to calculate the adjusted earnings-related allowance even for small earnings. – A-kassa member

For the most part, the respondents found the staggering of earnings-related allowance, the extension and the monetary valuation of the employment condition, the extension of the qualifying period and the periodisation of holiday compensation a hindrance or a neutral factor in finding employment. Answers to open-ended questions revealed that many think the changes bring more uncertainty and make finding employment more difficult rather than easier. Based on the survey, the government’s austerity measures add up to financial risks rather than an incentive to get back to working life.

- Staggering of earnings-related allowance: 58% of the respondents said that the staggering has worsened their situation on the job market.

- Extension of employment condition to 12 months: More than half, 54%, stated that this had worsened their employment situation.

- Employment condition linked to euros earned: 45% feel it has worsened their situation.

The survey results do not indicate any of the legislative amendments markedly improving the respondents’ employment situation.

The removal of the protected part and the monetary valuation significantly diminished my desire to work. – A-kassa member

Share of people on general social security benefits has increased

One in every five respondents said they had to switch from earnings-related unemployment security to Kela’s general social security. This was particularly common among unemployed members: nearly 30% of the unemployed respondents said they had switched over to Kela’s basic unemployment allowance, labour market subsidy or even social assistance. In particular, the staggering and the more stringent employment condition have resulted in situations where the conditions for earnings-related allowance are no longer met, even with an ample work history.

Providing for a child has become very difficult. Thankfully their other guardian helps, otherwise my child would have to give up their hobbies completely. As a result of the cuts, my earnings-related allowance and housing allowance provide just barely enough to feed myself and my child and pay the rent. – A-kassa member

I would have no need for social assistance if I got the child increments and the supplementary amount. I would also be more inclined to work occasionally while studying if the protected part wasn’t removed. Now I always have to contemplate whether I should do a shift or not. – A-kassa member

Legislative amendments did not remove obstacles to finding employment

According to the survey, the biggest obstacles for finding employment are related to issues that legislative amendments are not capable of addressing. The most common ones mentioned included age, specifically discrimination experienced by those over 55, as well as mental health issues, work ability limitations and lack of available jobs. Many respondents summed up the problem by stating that the issue is not about unwillingness to work but rather about the fact that there are not enough open vacancies and that accepting short-term employment is not financially worthwhile. In other words, the cuts do not remove any of the obstacles but rather just lower the level of financial security and add to a feeling of uncertainty.

– The government cuts do not remove age discrimination nor do they create new jobs. It is sad to see our members in such predicaments due to the amendments. It is important to us to make our members’ voices heard. And they were loud and clear in the more than 1,000 responses given to the open-ended questions in our survey. We appreciate that our members made the effort to write about their personal, sometimes even painful experiences related to their unemployment, Tikka sums up.

I look ahead with dread as unemployment benefits are staggered and there is no work available for a woman over the age of 55. – A-kassa member

The survey was conducted via a questionnaire submitted with an A-kassa member newsletter. 864 members responded to the survey.

Respondents’ background information

More than half (53%) of the respondents were aged 55 to 65. The next biggest age groups were 45- to 55-year-olds (25%) and 35- to 45-year-olds (16%). Only a few younger members participated in the survey – less than 5% of the respondents were under the age of 35, while a few individual respondents were under 25 or over 65.

Job market position: The respondents’ current employment situation varied, but fully unemployed was the biggest single group. Approximately 40% of the respondents (345 people) said that they were unemployed at the time of the survey. The next largest group consisted of members who were working full-time (28%). 15% of the respondents said they were working part-time, and approximately 5% were laid off. 10% chose the ‘Other’ category for their job market position (student, sick leave, disability pension). Based on their answers to the open-ended questions, many of them could be included in the ‘working part-time’ category.

Industry distribution: Industries represented by the respondents were mostly of the traditional sort. The largest respondent group came from heavy industries (metal, forest, chemical etc.), accounting for about 30% of all respondents. The construction industry formed another major contingent (approx. 17%) as did transport and logistics (13%). Arts and culture amounted to 8%.