Register as an unemployed jobseeker

Fill in the application in the eService

If you have become unemployed,read the brief instructions below first to get you well started. You can find more information after the brief instructions.

1. Register as an unemployed jobseeker in the E-services at Job Market Finland

2. Fill in the earnings-related daily allowance application in the eService

3. Add attachments to the application

4. Submit your application at the end of the application period

5. Provide missing information

6. Notify us of any changes

The processing status of your application is displayed on the eService homepage and the Status Information tab. The up-to-date processing status of your application is available here.

Apply online for an earnings-related unemployment allowance in our eService.

Add attachments to the application in our eServices. You can send an application even if you do not have all the attachments available. However, we will not be able to process your application before you have submitted all the necessary attachments:

Attach the necessary information to your application for processing. If there are any changes in your circumstances affecting your entitlement to daily allowance, please notify us promptly. You do not have to submit original attachments. Copies are acceptable. We will also accept, for example, a picture taken with a mobile phone of an attachment, if it is legible.

Send the attachments to us as soon as you receive them. Attachments sent through eServices will arrive immediately. Our processor will contact you if we need more information in order to process your application.

Notice of dismissal or pink slip

If your open-ended employment has ended, please send us a copy of the notice of dismissal.

Tax card

We receive your tax card information directly from the tax authority. We recommend that you apply for a revised tax card for the benefit, in which case tax will be withheld according to the information in the tax card. If you use your tax card for wage income when applying for a benefit, the withholding tax is always at least 25 per cent. You can order a revised tax card for the benefit from the Tax Administration's MyTax service. In the MyTax service, you can send the revised tax card electronically directly to us by selecting the Open Unemployment Fund as the payer of the benefit.

Personal tax decision

If you have a business, please provide us with a personal tax decision on the most recently confirmed taxation. Also submit the breakdown part of the tax decision if you are a shareholder in a limited liability company or cooperative, or a partner in a general or limited partnership. If you are a shareholder in an estate, in addition to the personal tax decision, also submit the tax decision for the estate.

Social benefits

If you receive a social benefit that affects the amount of your daily allowance (for example home care allowance, partial disability pension or partial care allowance), submit the decision on granting the benefit to us. Be sure to also report any changes in the amount of the benefit. If the social security benefit has been granted by Kela, a simple notification of the benefit, for example, in the additional information in the daily allowance application, is sufficient.

Salary information

You do not need to send a payslip, as we receive salary payment data directly from the Incomes Register. However, if the Incomes Register data is incomplete, we may ask you, for example, for a payslip or a salary statement.

An earnings-related daily allowance cannot be applied for in advance.

Example: If you are applying for a daily allowance for four calendar weeks from 5 April to 2 May 2021, you can send the application to the cashier no earlier than Sunday 2 May 2021.

Our processor will contact you if we need more information in order to process your application. Please submit any missing attachments or additional clarifications we have requested through our e-Services.

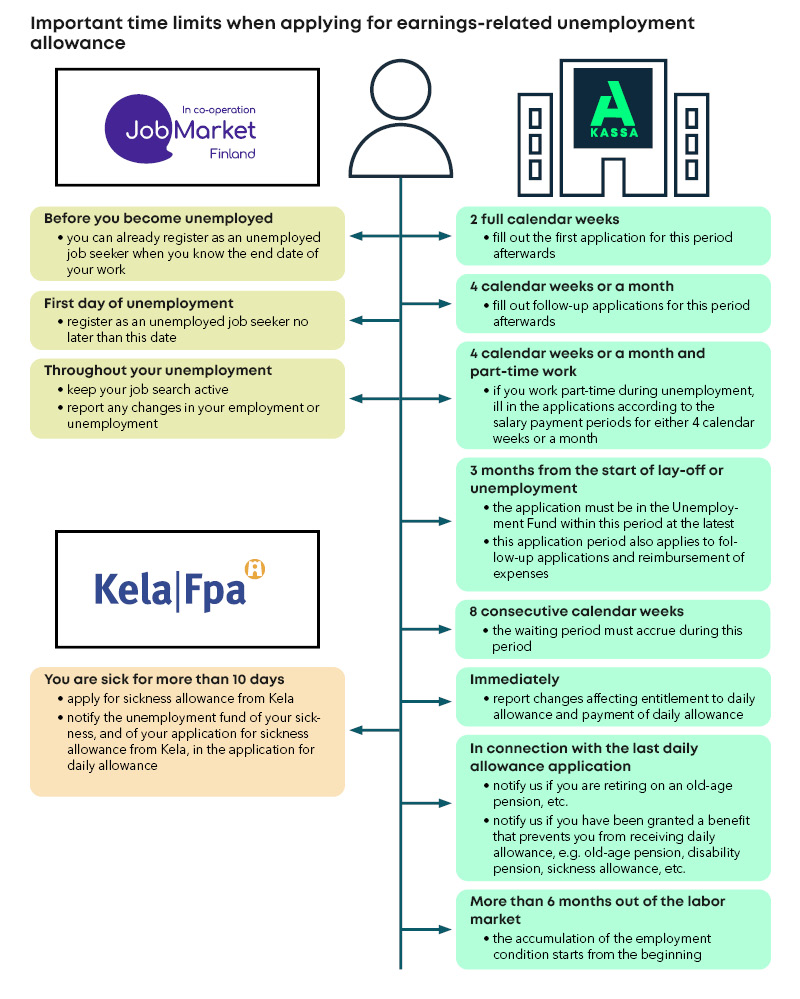

Remember to notify us of any changes affecting your entitlement to daily allowance and any changes in your personal and contact information.

Notify us promptly of any changes affecting your entitlement to daily allowance and the payment of daily allowance in your situation. You should also keep your information up-to-date for the processing of your application. You can report changes through eServices, or by post. You can also provide some of the information by calling our service number.

If you or your spouse are paid child home care allowance, please indicate this in the application. If your spouse receives child home care allowance, include more detailed information on your spouse's possible employment and studies and on the person caring for the child. You should also notify us of any changes in child home care allowance or the discontinuation of the allowance. Decisions on child home care allowance do not need to be sent to us.

If your employment ends, notify us of this in your daily allowance application and to the employment authority. If your full-time employment becomes part-time at the initiative of the employer, please send us a copy of the employment contract.

Please notify us in your application if you no longer apply for daily allowance in the future. If you start full-time employment lasting more than two weeks, notify the employment authority. Also notify us of the start of employment with your latest daily allowance application.

If you retire on an old-age pension or have been granted another benefit that prevents you from receiving the daily allowance, please notify us at the latest in connection with your last application for a daily allowance. If you wish, you can retire on an old-age pension already after the age of 62, if you have been paid a daily allowance for additional days.

You will need a certificate for the pension company from the fund about the additional days paid. Ask for a certificate when you are applying for a daily allowance for the month before your pension. We cannot write the certificate earlier, because the pension company needs information about the additional days of the month preceding the pension.

Send the decision on granting the pension to us either through eServices or by post. You do not need to send a new decision annually on the size of the pension resulting from indexation. The data is submitted to us directly from the Incomes Register. If you receive a partial early old-age pension, the decision on granting the pension does not need to be sent to us. A partial early old-age pension does not affect the payment of an earnings-related daily allowance.

If you fall ill and your illness lasts more than ten days, you can claim sickness allowance from Kela. Report your illness via an application. Also indicate on the application whether you have claimed sickness allowance from Kela. The waiting period for qualifying for sickness allowance is the first day of illness plus the following nine days (including Saturdays). In the event of an accident or the same illness within 30 days, the waiting period is one day.

We can pay an earnings-related daily allowance for the waiting period of the sickness allowance if you have received unemployment benefit just before the illness. Read more about falling ill during unemployment here.

Account number

You can provide a new account number in eService, notify it in your application or send it in writing by post. You cannot provide a new account number over the phone.

Contact details

You can notify us of a change of address or a new phone number in eServices, by entering the information in, the additional information section of the follow-up application or by calling the service number. Back to the top